After the Federal Reserve cut interest rates, the question that arises is what will be the next driver of Bitcoin sentiment?

In the price action analysis on September 24, 2024, Bitcoin showed stability around US$63,000 after experiencing significant volatility earlier. Early last week, the price of BTC dropped from over US$60,000 to below US$58,000, but surged after interest rate cut announcement by 0.5 percent (50 bps) by the Fed. This surge brought the price of Bitcoin past US$64,000 on Friday, making it the highest price in the last three weeks.

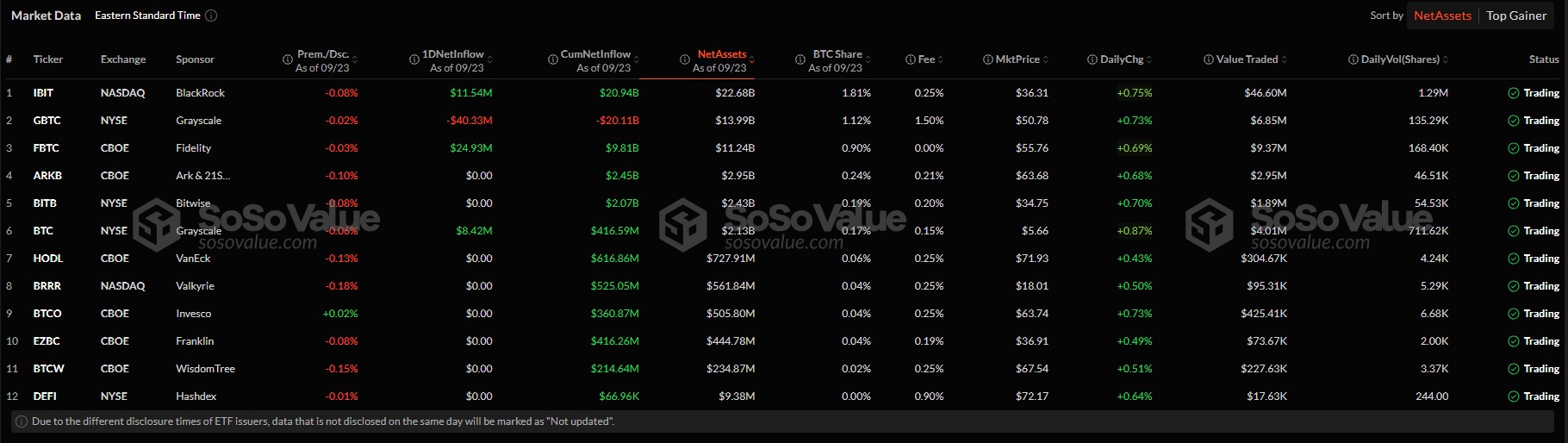

Data from Social Value showed Bitcoin Spot ETF inflows reached US$397 million for the period from September 16 to 20, reflecting growing interest from institutions. In addition, plans to invest more than US$30 billion by BlackRock and Microsoft in artificial intelligence (AI) infrastructure also influenced market sentiment, driving up AI-based altcoins, such as TAO and FET, which recorded increases of 87% and 30% respectively.

Although on September 24, 2024 at 09:00 WIB Bitcoin was trading around US$62,905, down 1.60 percent in the last 24 hours, the price still reflects a 9.12 percent increase in a week. BTC's market capitalization is at US$1.245 trillion, with technical analysis showing potential movement sideways in the range of US$60,000 to US$65,000 for this week.

Panji Yudha, Financial Expert Ajaib Kripto, stated that last week's increase was driven after the Federal Reserve took an aggressive step by lowering the benchmark interest rate by 50 basis points, from the range of 5.25-5.5 percent to 4.75-5 percent.

“This looser monetary policy is also expected to have a positive impact on crypto assets, especially Bitcoin. With low interest rates, investors will be more interested in high-yielding assets such as crypto,” Panji said in a written statement via email.

BlackRock: Bitcoin as Diversifying Asset Amid Global Uncertainty

The Next Driver of Bitcoin Sentiment

Panji continued, several important factors that will drive Bitcoin sentiment in the future include reports Consumer Confidence & Sentiment which will be released on September 24. This report measures public optimism about the state of the economy. If the results are positive, this could encourage spending and have a positive impact on speculative assets such as Bitcoin. In this context, the factors driving Bitcoin sentiment become increasingly relevant.

Next, on September 26, the updated US second-quarter GDP report will be in the spotlight. With a predicted growth of 2.8 percent, this increase could boost confidence in the US economy, which could also have a positive impact on Bitcoin. The same day, weekly jobless claims data will also be released, with a forecast increase to 224 thousand. All of these are part of the Bitcoin sentiment drivers that investors should pay attention to.

Federal Reserve Chairman Jerome Powell's speech, scheduled for September 26, 2024, will also be highly anticipated.

“The market is expecting a statement from Powell after the 0.5 percent rate cut, which has the potential to affect the overall crypto market sentiment. The market response to Powell's remarks could be one of the driving factors for Bitcoin sentiment,” he said.

On the other hand, the Core PCE inflation report due on September 27 will also be key. If inflation is lower than expected, there is a possibility of further interest rate cuts, which would usually benefit Bitcoin and other crypto assets.

Overall, volatility in the crypto market is expected to increase depending on the outcome of economic data released throughout the week.

Investor sentiment towards Bitcoin will be heavily influenced by these reports, as well as the market's response to the monetary policy taken by the Fed.

As the global economy evolves, attention to these factors will be key to understanding where Bitcoin is headed in the future. As such, the drivers of Bitcoin sentiment will continue to be a focus for investors. [ps]