After BTC successfully retraced its path above $60,000 early Saturday, a number of analysts echoed his comments. One of them is that there are a number of significant obstacles for the number one crypto to survive.

On Saturday, September 14, 2024, at 06.00 WIB, BTC crypto again surged to US$60,669, slightly surpassing level psychology is very important.

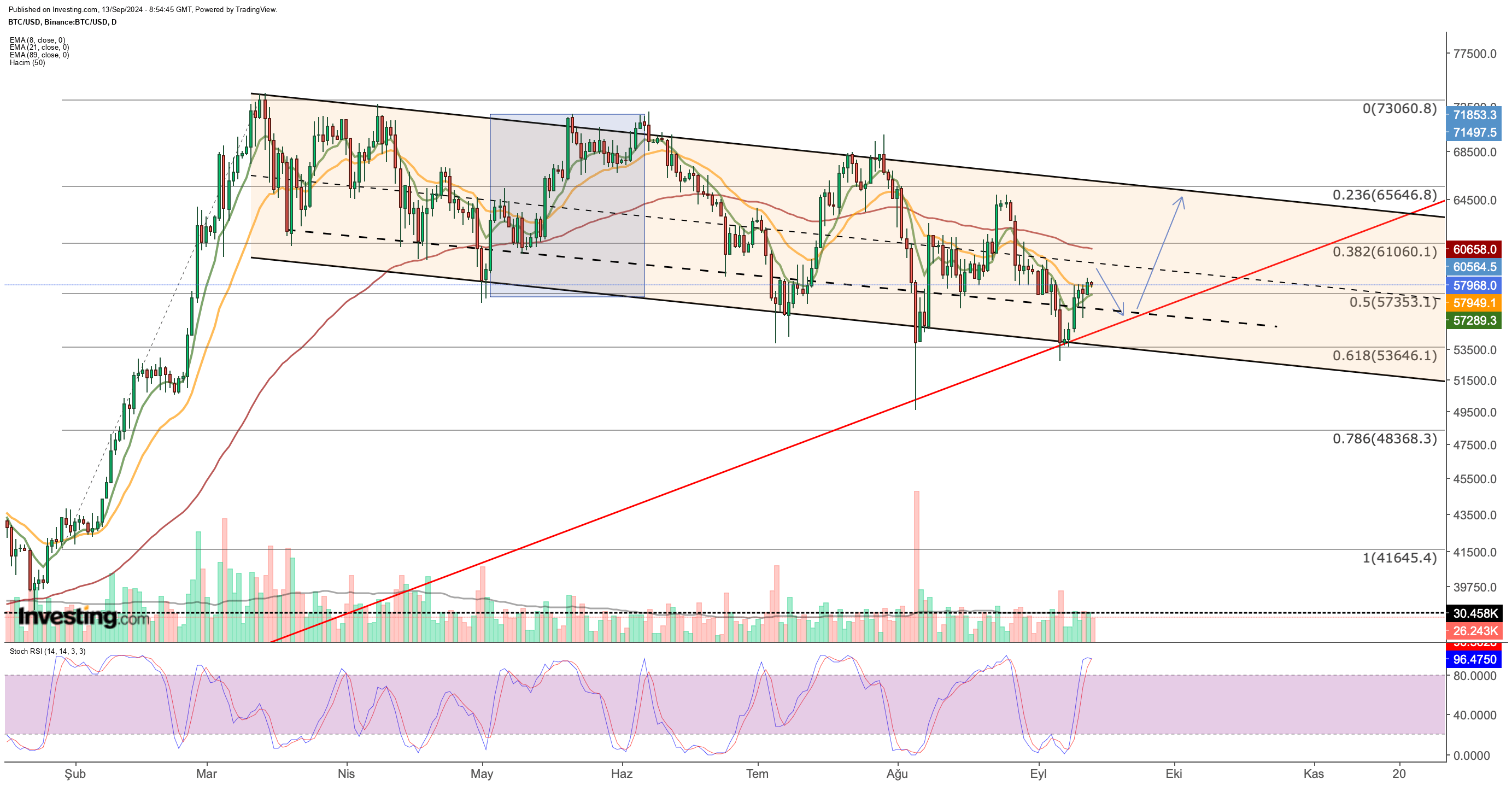

Targeting US$65K, BTC Crypto Could Be Blocked by US$61K

Bitcoin prices have indeed shown significant movement this week, amidst a slowing decline. Demand for BTC crypto has increased after testing support at the bottom limit descending channel for the fourth time since March 2024.

Some time ago, crypto analyst Günay Caymaz in Investing.comexplaining that the lower limit channel The BTC crypto has started to strengthen in recent months, even though the price has experienced a significant decline.

“The dotted line seen on the graph shows how the lower limit channel has expanded in recent months,” he said.

Rebound The early price of this week is in line with an uptrend line that started in September 2023. Although this line lost its significance during the price surge at the beginning of the year, the uptrend has returned to play a role support level in the current correction phase.

“We should continue to monitor this trend as a key factor over the next few days,” Caymaz added.

With the current latest BTC crypto price, it has broken through the middle line channel at US$59,000 with significant trading volume. Referring to Caymaz's analysis, he expects a similar rally to last May.

“There is a possibility we could see prices reach $65,000 if the momentum continues,” he said.

Current technical indicators also show a pattern similar to the price movement in early May. This indicates a potential price increase to US$65,000.

“However, resistance The middle ground around US$61,000 could be a challenge for BTC crypto to continue its rally. Level “That might provide some resistance before prices can move higher,” Caymaz said.

US$64,000 Resistance Test

Previously, analysts from Secure Digital Market (SDM) had predicted an increase above US$60 thousand, after earlier today, the price of BTC crypto jumped more than US$1,500, from US$58,000 to US$59,700.

They note that this spike is in line with a pattern of increasing short-term volatility, oscillating in a descending channel over the past six months.

“If this trend continues, we could see BTC crypto testing level US$62,000 to US$64,000 next week,” said the HR analyst.

On the other hand, according to them, Ethereum (ETH) continues to lag. The daily ETH/BTC chart shows no signs of slowing down the bearish momentum, indicating that ETH may have a hard time competing with Bitcoin in the near term.

For the Continued Rally, Level US$61,500 Must Be Support

Crypto analyst Jason Pizzino said the same thing. Youtube not long ago, where he said the phase bullish The next Bitcoin will start after the BTC crypto successfully converts level US$61,500 from resistance to support.

“If we start to see some tests and closes above $58,000 in the short term, this could be the start of a nice bounce to test level more importantly in my analysis, around US$61,500. This is level the next key for Bitcoin to test, break through, and consolidate on top of it, which will essentially start phase next from bull marketpushing prices up level new all-time high,” he said.

However, Pizzino warned that volatility could still be a major factor, and BTC crypto could potentially fall more than 15 percent from level currently without canceling the scenario bullish-his.

“Bitcoin is still above around US$52,000, US$53,000 and level August's low of US$49,000 is still intact here. We have seen levels it was previously on the lower side–if it goes back down, BTC crypto remains in the market macro bullish if it gets back to the mid-$40,000s. And from there, a close back above $61,500 would start the move up,” he said. [ps]