A big shift seems to be happening among the rich people of RI. Fear of fiscal uncertainty and economic stability makes Indonesian conglomerates choose the silent path: Cryptocurrency.

Indonesian conglomerates are restless, the economy is considered unstable

As up Prabowo Subianto As the 8th President of the Republic of Indonesia in October 2024, Indonesia’s upper class began to divert their funds abroad.

According to reports Bloomberg On April 12, this transfer was not only in the form of gold or property abroad, but also flowed profusely to digital assets, especially stablecoin Famous belongs to Tting, namely USDT.

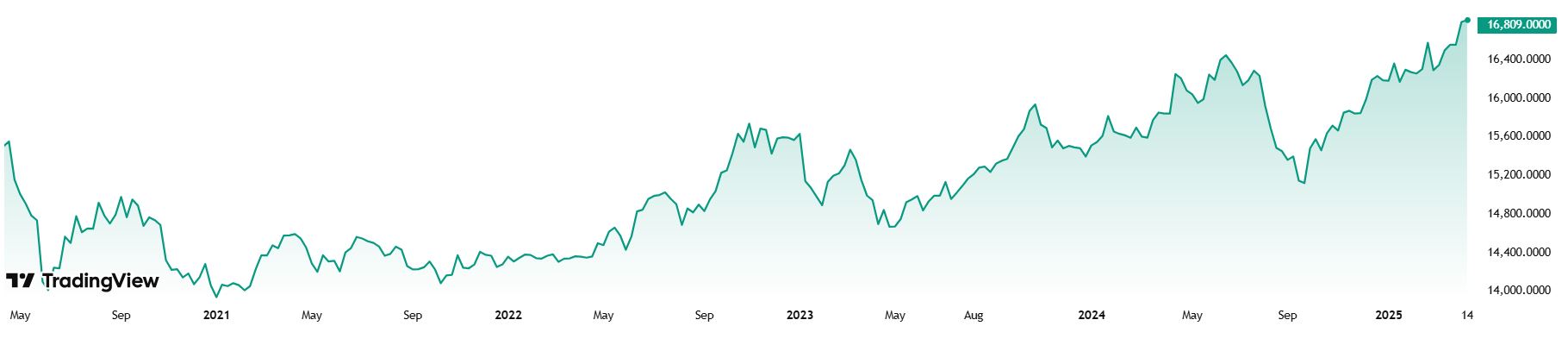

This crypto asset is attractive to the rich people of RI who are looking for an escape, because the value is pegged against the US dollar, making it safer than the fluctuation of the rupiah. This shift is increasingly felt after the rupiah exchange rate touched the lowest point in the last five years on April 9, 2025, namely reaching level Rp16,957.

In addition, uncertainty regarding Prabowo’s fiscal policy-which encourages massive state expenditure and expands the role of the military and SOEs-making many investors feel panic.

Many Indonesian elites are starting to worry, because of the policy economy It is feared that it will trigger a budget deficit, debt surge, and inflationary pressure. Not to mention a number of polemic policies that emerged lately further exacerbated market sentiment.

“I have continued to buy USDT in recent months. This is the most efficient way to protect assets and divert it abroad without having to pass conventional banking procedures,” said Chan, a former executive at one of the Indonesian conglomerates.

From property to Cryptocurrency

The report also revealed that since February 2025, one of the financial advisory firms recorded the flow of funds of funds of around US $ 50 million from his client to Dubai and Abu Dhabi. Most of these funds are used to buy property in the name of the family or colleague so as not to be detected.

Dubai Now it is a new alternative for the rich people of RI who began to leave Singapore because of the tight post-scandal regulation of large money laundering in the country. Meanwhile, digital assets emerged as a agile tool in the mobilization of funds. Although its nature is volatile, flexibility makes it very interesting.

In Indonesia, the USDT/rupiah pair transaction now contributes more than a quarter of the daily volume of Tokocrypto, according to their CMO, Wan Iqbal. No wonder that Indonesia is currently a country with a level The fifth highest crypto adoption in this world.

Waves of Adoption of Crypto Extensive in Asia

This phenomenon does not only occur in Indonesia. Based on previous reports, as many as 76 percent Rich Investors in Asia has now invested in digital assets. In fact, the other 18 percent said they would soon follow the step.

This figure shows a significant increase compared to only 58 percent in 2022. This surge is inseparable from the increasingly popular blockchain technology and the increasing need for diversification of assets in the midst of uncertain economic climate.

Meanwhile, report Other related to Visa research revealed that the community also began to view stablecoin As an alternative to traditional banking services – the choice is now also adopted by the Indonesian elite.

These findings certainly further strengthen position Cryptocurrency As one of the relevant financial solutions and is not just a speculative instrument.

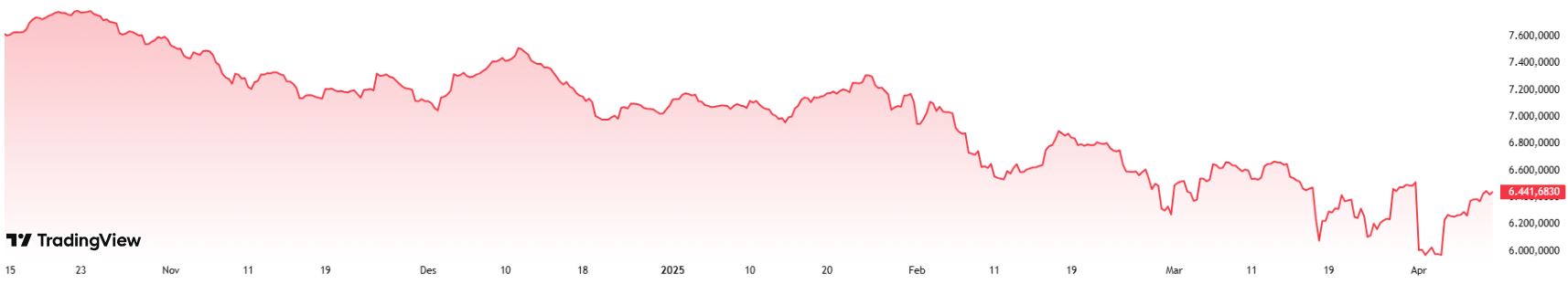

JCI is lying, crypto is a runaway

Data The latest from TradingView strengthens the narrative about the escape of the RI RIGHT RI: CSPI continues to decline in the last six months. From the range of Rp7,700 at the end of 2024, the index has now fallen to level Rp6,441 and had touched under Rp. 6,000.

Market panic is clearly visible. Value protective assets such as gold recorded a surge in sales of up to 30 percent in the first quarter of 2025, according to Hartadinata Abadi, the largest non-BUMN gold retailer in Indonesia.

Although not yet as big as the exodus of capital during the 1998 crisis, the Indonesian conglomerate escape trend this time gave a strong signal that trust investor being tested. Analyst from Global Counsel, Dedi Dinarto, assessed that Prabowo needs to immediately provide a clear certainty and commitment.

In the shadow of uncertainty and economic policy, crypto does not seem to be just a trend. For the Indonesian elite, he has been transformed into “Lifeboat“Digital – rescue tools that are ready to bring their wealth across political and economic storms. [dp]