Strategy, one of the public companies that has now become the largest bitcoin holderit turns out to have a significant impact on the market. According to analysts, the massive accumulation carried out by this company made BTC begin to enter the deflation phase.

Bitcoin Entering the Deflation Era

Strategy is quite widely known as the largest bitcoin holder at the moment – currently collecting BTC in a distance that exceeds the total production of miners.

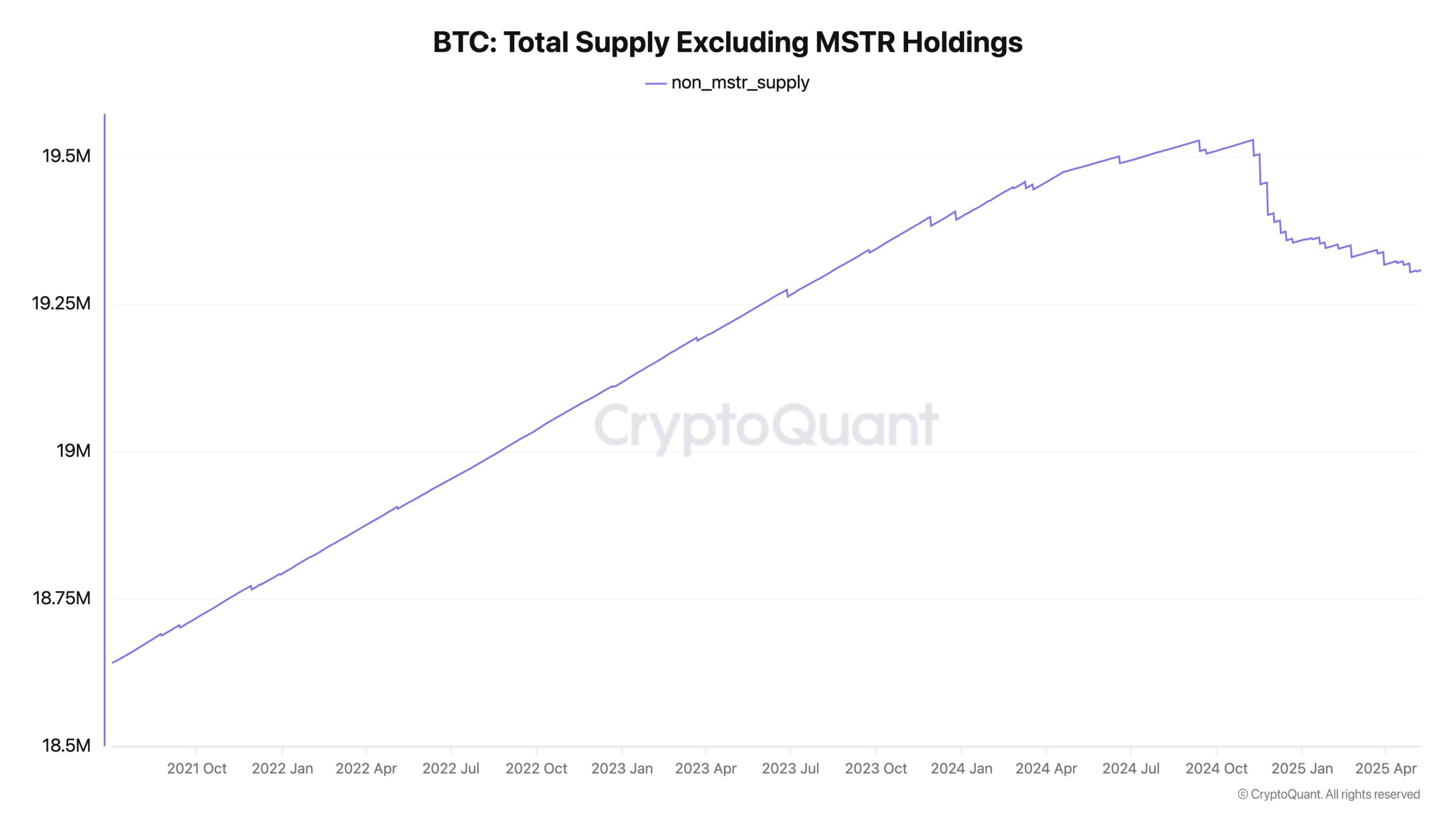

In the upload On X on May 10, Cryptoquant’s analyst and CEO, Ki Young Ju, shared data that shows that the rate of accumulation by strategy has created real deflation pressure on the market.

Ju also revealed that the strategy is now controlling more than 555,000 BTC, all of them Illiquid or will not be sold in the near future. According to him, this condition encouraged the annual degree of deflation to level which is quite high.

“MSTR ownership alone has led to an annual deflation rate of -2.23 percent -it is likely to be higher if it takes into account other large institutions that are also stable,” he explained in X.

Strategy to collect funds from investors Tradfi By selling debts and shares, then allocating it to buy more bitcoin. As a result, the supply of BTC in the market is increasingly limited, encouraging prices to continue to creep up.

The accumulation of strategy exceeds production Miner

Overall, this condition shows that BTC is now experiencing an active deflation phase – a phenomenon that is very rare in crypto assets and can have an impact on market dynamics.

Previously, a similar view revealed By Adam Livingston, Author The Bitcoin Age and the Great Harvestwhich states that the strategy has created effects Halving with an accumulation rate that is far exceeding the production capacity of the miners.

“When Bitcoin is more rare, access to it will require premium prices. Borrowing will become more expensive. In fact, BTC borrowing will become an exclusive business that can only be done by large countries or corporations, with strategy as the main controller of supply,” Livingston said, Sunday (27/04/2025).

He also added that at this time, Para Miner only produces around 450 BTC per day, while the strategy accumulates an average of 2,087 BTC per day-more than four times the daily production of miners.

Institutional interest continues to flow

This condition is further strengthened by the increasing interest of institutional investors towards bitcoin, both through direct purchases and products such as Bitcoin Spot ETF.

Based on data The latest from Sosvalue, a very positive flow of funds seen since mid -April, reflects the strong trust of large investors of Bitcoin long -term prospects.

In addition, many major institutions are now starting to make BTC as one of the main commodities in their portfolio diversification and as a hedge for values against currency inflation Fiat.

This further increases the demand pressure without being balanced with an increase in comparable supply, creating an increasingly competitive market condition in obtaining BTC.

Strategy Opens Bitcoin’s New Era

Strategy not only buy Bitcoin – they change their market structure. By locking more than half a million BTC and minimizing liquidity, this company effectively reduces daily supply.

Meanwhile, Para Miner Working hard to produce hundreds of BTCs every day, Strategy absorb thousands. This creates an imbalance between supply and demand, further strengthens the company’s position as the main controller in the market.

Peter Schiff: The fall of Bitcoin can be the end of the strategy

This condition marks a new chapter on Bitcoin’s journey – where large institution Not only being a player, but also a market direction control. And if this trend continues, BTC ownership can be a luxury that is only available for a few parties. [dp]