Tokocrypto CEO, Yudhono Rawis, confirmed that there was no significant decline in crypto investor interest following the hack. crypto exchange local that occurred on September 11, 2024.

He also emphasized that the crypto industry in Indonesia remains strong, thanks to the security mitigation measures implemented by related companies.

Yudhono Rawis, who also serves as Deputy Chairman of the Indonesian Crypto Traders Association (Aspakrindo) and the Indonesian Blockchain Association (ABI) explained that collaboration between associations and industry players is very important to ensure security and comfort for investors.

“We understand that incidents such as hacking can be concerning, but we are committed to continuing to strengthen security standards, as well as maintaining transparency in managing customer assets,” said Yudhono in a written statement via email, Thursday (19/9/2024).

Yudhono also added that one of the factors that maintains investor confidence is the existence of strict regulations. Platform such as Tokocrypto has taken various mitigation measures to ensure that the hacking incident does not have a major impact.

“Indonesia has succeeded in strengthening its position in the global digital asset space, as evidenced by world's third largest crypto adoption country by 2024 according to Chainalysis. This shows that trust in the Indonesian crypto ecosystem remains strong,” Yudhono added.

Security measures implemented in platform Local crypto not only increases trust, but also creates a safer environment for all industry players. Tokocrypto itself has strengthened their system by using technology cold wallet to store customer assets, as well as implement multi-signature wallets and multifactor authentication (MFA).

Indodax Hacking Incident Highlights Importance of Using Hardware Wallet

“We have expanded usage cold wallet to minimize the risk of hacking, as well as implementing multi-signature wallets and MFA to improve asset protection and user access,” Yudhono explained further.

Besides that, platform such as Tokocrypto has also obtained international security certifications such as ISO 27001 and ISO 27017, as well as introducing artificial intelligence (AI) based technology to detect suspicious activity online. real time. Security audits conducted by independent third parties are also part of the security measures taken to prevent hacking.

For investors, Yudhono suggests that they choose crypto traders that are registered with Bappebti and have a good reputation. Security certifications such as ISO 27001 and the implementation of high-security technology are important indicators in ensuring the security of customer assets.

“We always educate investors to be more careful in choosing platform to transact. Knowing the security policies implemented by platform is an important step to minimize the risk of hacking,” Yudhono continued.

In the midst of efforts to fulfill licensing regulations Physical Crypto Asset Traders (PFAK) before October 16 2024, Yudhono also emphasized the importance of complying with regulations.

He even asked companies that had not yet obtained a license to immediately complete the process.

“Companies that have been officially registered with Bappebti and have a PFAK license demonstrate their commitment to security, transparency, and higher operational standards,” said Yudhono.

Indonesia Rises to 3rd in World Ranking for Crypto Asset Adoption

With these increasingly stringent measures, the Indonesian crypto industry is expected to continue to grow without sacrificing security and regulatory compliance.

“Platform that have obtained PFAK licenses now rely on government-regulated crypto asset storage institutions. This is part of our efforts to continue to improve security and meet applicable regulatory requirements,” Yudhono added.

For assets fiat, platform PFAK has implemented best practices by keeping 70 percent of funds in a trusted clearing institution and 30 percent in platform Alone.

A similar approach is also applied to crypto assets, where the majority (70 percent) are stored in crypto-specific depository institutions to minimize the risk of theft or loss. With these steps, crypto business actors in Indonesia are optimistic that investors will still feel safe and confident in transacting through local platforms, even though the threat of hacking still exists.

Indonesian Crypto Asset Exchange Inaugurated: Regulation, Challenges and Opportunities

15 Companies Crypto Exchange Indonesia Has Not Yet Obtained PFAK License

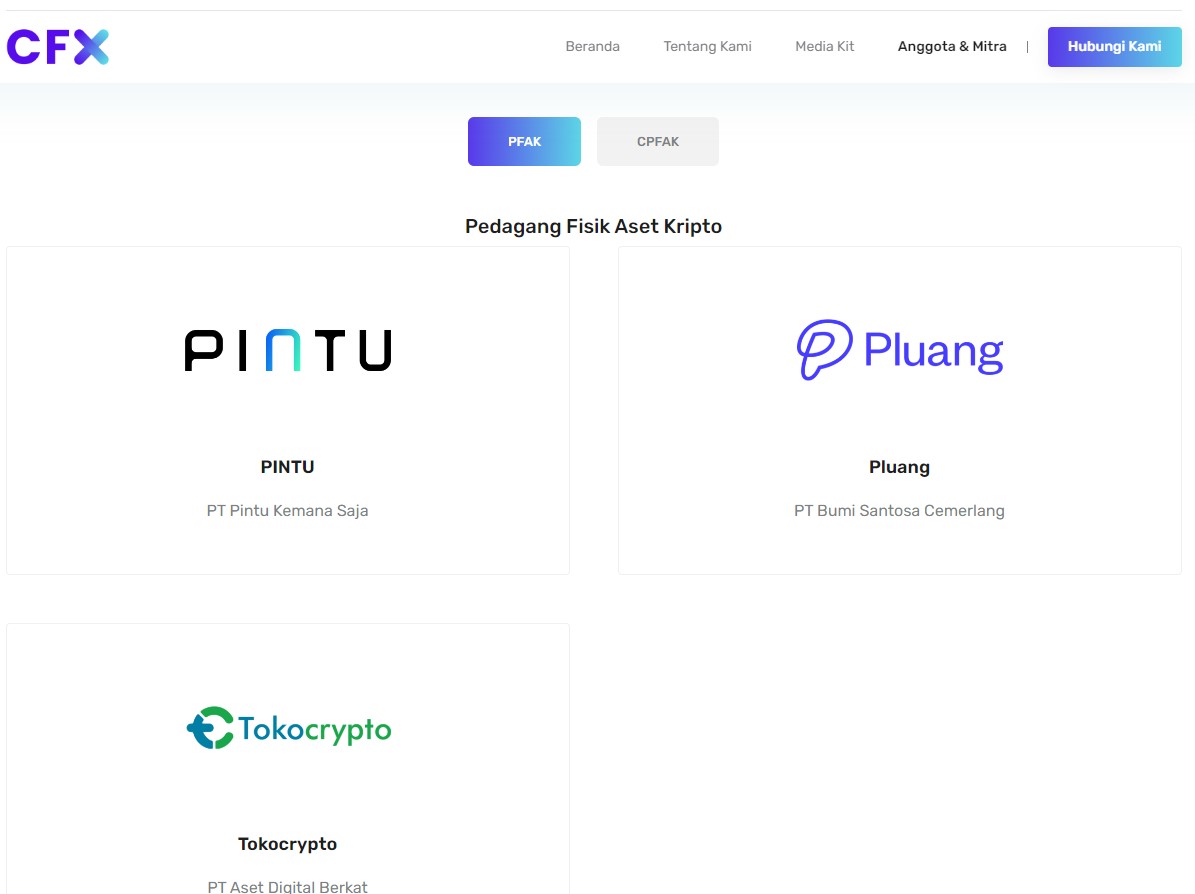

Based on the editorial team's search Blockchainmedia.id from Indonesian crypto asset exchange, CFXonly 3 companies crypto exchange as members of the exchange in Indonesia who have a license from Bappebti as a Physical Crypto Asset Trader (PFAK), namely Pintu (PT Pintu Kemana Saja), Pluang (PT Bumi Santosa Cemerlang), and Tokocrypto (PT Aset Digital Berkat).

The remaining 15 have only the status of Prospective Physical Crypto Asset Traders (CPFAK), namely KMK (PT Kripto Maksima Koin), Ajaib (PT Kagum Teknologi Indonesia), Stockbit Crypto (PT Coinbit Digital Indonesia), MAKS (PT Mitra Kripto Sukses), Mobee (PT CTXG Indonesia Berkarya), Bitwewe (PT Sentra Bitwewe Indonesia), Coinvest (PT Pedagang Aset Kripto), Fasset (PT Gerbang Aset Digital), Vonix (PT Samuel Kripto Indonesia), Astal (PT Aset Instrumen Digital), Coinx (PT Kripto Inovasi Nusantara), NVX (PT Aset Kripto Internasional), Triv (PT Tiga Inti Utama), Reku (PT Rekeningku Dotcom Indonesia), and GudangKripto (PT Gudang Kripto Indonesia).

Then there are two entities that are classified as partners in the operation of the CFX crypto exchange, namely ICC (PT Kustodian Koin Indonesia) and KKI (PT Kliring Komoditi Indonesia), each as a crypto asset custodian institution and a transaction clearing institution.

Crypto custodians and clearing companies play a vital role in the crypto asset trading ecosystem. The main function of a custodian company is to store customers' digital assets safely. They use technologies such as cold wallet which keeps assets protected from potential hacking or theft. Custodians also separate customer assets from company assets to ensure further security, as well as ensuring that the assets are not used for company operational purposes.

Meanwhile, the clearing company is responsible for guaranteeing settlement (settlement) transactions between transacting parties. They ensure that the crypto assets traded are delivered correctly, and that funds from the sale or purchase are acknowledged and received by the relevant parties. In doing so, clearing firms help reduce the risk of default and ensure transparency in the transaction process, creating a safer and more reliable environment for industry players. [ps]