PEPE price correction in the last 24 hours occurred by 3.86 percent. Price meme coin This also plunged to US$0.00000795, only experiencing a brief increase a few days ago. Will the PEPE price correction continue?

This PEPE price correction occurred across the global crypto market, where Crypto Fear and Greed Index dropped from a score of 30 to 29 in the last 24 hours. Even the crypto market capitalization fell 3 percent to US$2.07 trillion in a day, according to data from Coinmarketcap.

The index is a common measuring tool used to gauge current sentiment in the crypto market, ranging from fear (fear) extreme to greed (greed) extreme. This index combines a variety of factors, including market volatility, trading volume, social media activity, and surveys, to provide a general overview of market sentiment.

The latest data suggests a small shift in market sentiment toward greater fear. Typically, lower index values indicate increased caution or anxiety among investors, perhaps due to factors such as market volatility, negative news, or broader economic uncertainty affecting crypto prices, including being a measure of when PEPE price corrections occur.

The decline from 30 to 29, while small, could reflect underlying market concerns or a response to recent events or trends that have slightly increased investor anxiety.

Meme Coin Popularity Is Inevitable, Its Super Cycle May Not Be Over Yet

Technical Analysis Potential PEPE Price Correction Could Continue

Based on the editorial team's review Coingapetechnically the current PEPE price is in the zone bearishbased on a symmetrical triangle pattern, aka symmetrical triangle pattern. This kind of pattern usually gives a strong signal that the pressure is bearish can continue.

“PEPE price correction is clearly visible in the trend bearishas shown by lower highs And lower lows which forms a symmetrical triangle pattern. The current price is trading below Exponential Moving Average (EMA) The 50-day is at US$0.00000829 and the 200-day EMA is at US$0.00000961, which reinforces the trend bearish. The recent PEPE price correction that broke through the triangle pattern, indicates a possible continuation of the downtrend. Pepe Coin price may find support around US$0.00000700, with level previous low was US$0.00000600,” he wrote. Coingape.

The symmetrical triangle pattern is one of the most common reversal or continuation patterns used in technical analysis. It forms when price moves in a narrowing range, with a trendline connecting declining highs and rising lows.

This pattern indicates that the market is in a consolidation phase, in the context of a PEPE price correction for example, where price volatility decreases and the market tends to be calmer. When the price finally breaks through one of the trend lines, either upwards or downwards, this can signal the beginning of a new trend. If the price breaks through to the upside, it is usually considered a signal bullishwhile if it breaks downwards, it is considered a signal bearish. In this case, the current PEPE price correction has penetrated the lower limit of the pattern, so it is interpreted that there will be a further decline.

This was also confirmed by Moving Average Convergence Divergence (MACD) Histogram which shows the signal bearish with increasing downward momentum. When the MACD histogram is below the zero line and shows bar which is getting longer in the negative direction, this indicates that the momentum of PEPE price correction is getting stronger. This means that selling pressure in the market is getting more dominant, and prices tend to move down more intensely.

Other Data: Whale Just Scoop Up PEPE

But other data shows a difference in trend. Based on the data on-chain alias transaction activity on the blockchain, it was revealed that the activity whale PEPE has increased in the last 48 hours.

Data from IntoTheBlock shows that the increase in large holder flows (whale) by 192 percent between August 13 and 14, 2024, indicating a positive sentiment. bullish against the asset, when a PEPE price correction occurs.

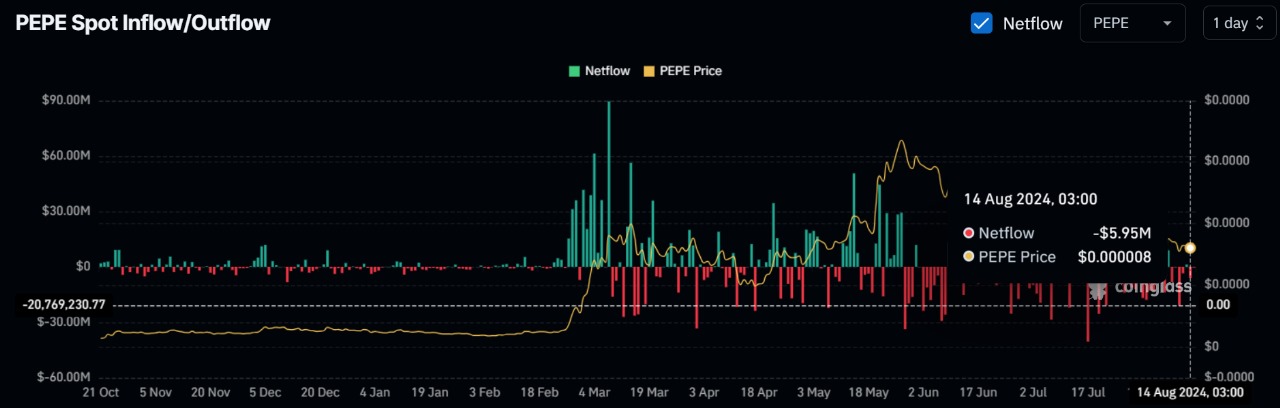

Next, the net flow (netflow) PEPE showed negative results on August 14, according to data from Coinglass. The previous day, there was about $5.95 million worth of PEPE in exchange reserves, up from the previous day's positive net flow of $1.27 million.

This, coupled with the increasing balance whaleindicating that large investors are accumulating Pepe Coin when PEPE price correction occurs, anticipating a possible trend reversal. bullish.

Analysis of data from Large Order Book PEPE revealed the existence of whale order worth US$2.6 million at prices around US$0.00000579 and US$0.00000670. Order it has been waiting for 9 days, showing that whale ready to buy more PEPE tokens at a lower price. This has the potential to push the price of Pepe Coin up, given the demand from large investors who are ready to buy at a discount. [ps]