Following promising statements from SEC Chairman Gary Gensler about an approval timeline for a spot Ethereum (ETH) ETF, Bloomberg Senior analyst Eric Balchunas has drawn renewed attention to a potential launch date.

Gensler hinted that approval could come sometime this summer, sparking excitement in the crypto community.

Balchunas Predictions: Reality or Speculation?

AMBCrypto reports, Eric Balchunas has pinpointed a potential start date for Ethereum ETFs, predicting that they could begin trading in the US as early as July 2nd.

“We moved up the Ether spot ETF launch date to July 2, heard that the staff sent comments to the issuer today, and it was pretty light, nothing major, asked them to come back in a week,” Balchunas said.

This statement has sparked optimism among investors, indicating that the regulatory process may be smoother and faster than anticipated.

News of a potential launch in July has sparked optimism within the crypto community especially regarding Ethereum's upcoming market opportunities. Balchunas also noted that the launch may be strategically timed to coincide with US Independence Day on July 4.

“Most likely they will declare it effective the following week and get it done before the holiday weekend. “Anything is possible, but this is our best guess at this time,” he added.

Comparing Bitcoin and Ethereum ETF Approval Processes

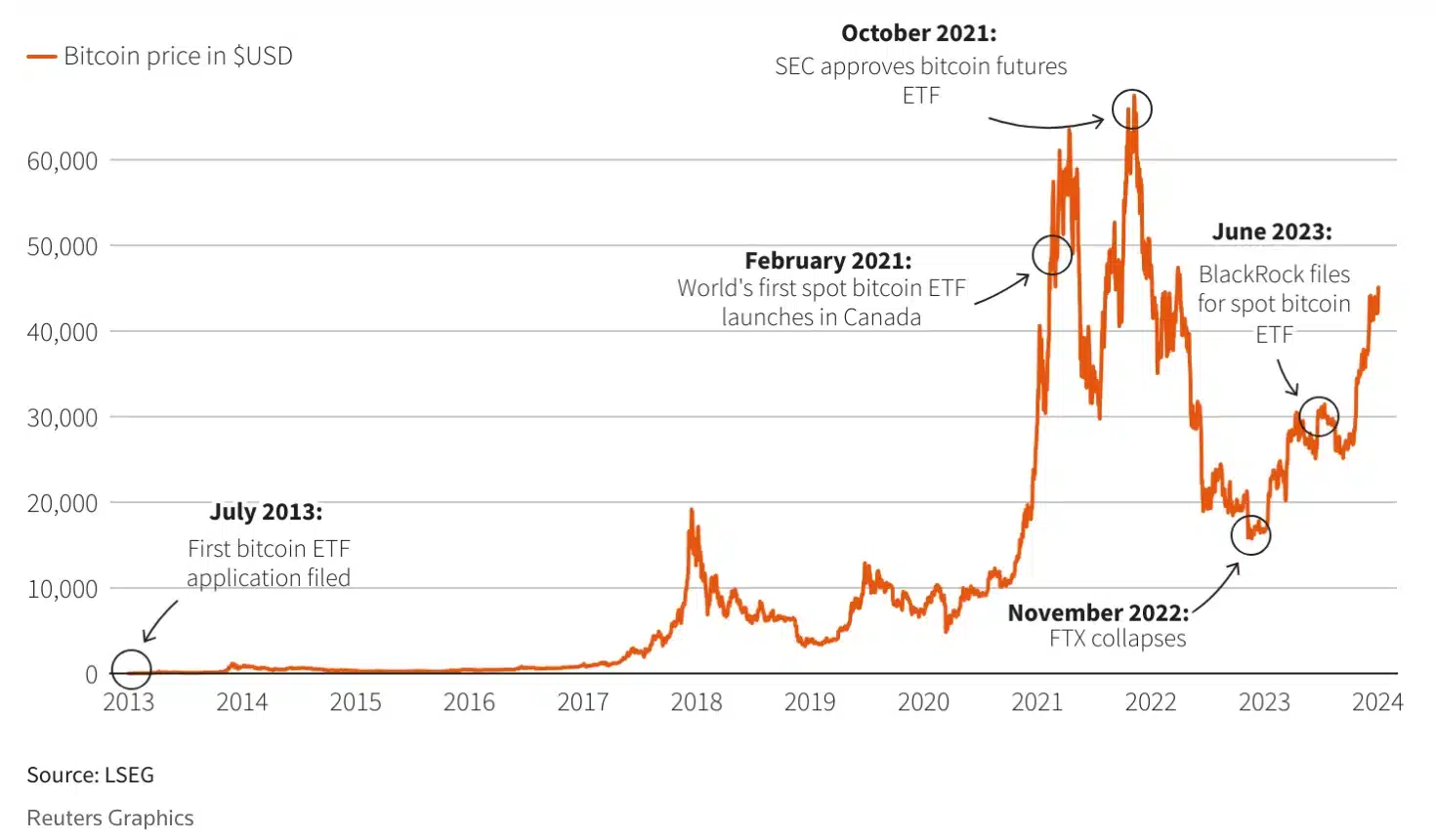

The anticipated approval for an ETH ETF reminds us of the long journey of Bitcoin (BTC) ETFs. The process for a Bitcoin ETF began in July 2013 when Cameron and Tyler Winklevoss, Founders of crypto exchange Gemini, submitted their initial application to the SEC.

It wasn't until January 2024, after nearly a decade of regulatory scrutiny and multiple applications, that the SEC finally approved 11 Bitcoin ETFs.

Drawing parallels between the Bitcoin and Ethereum ETF approval processes, it is worth noting that following the BTC ETF approval, Ethereum experienced a significant rally, rising by 9.1 percent, while Bitcoin underperformed.

Now, with the anticipated approval of an ETH ETF, Ethereum, altcoins second largest, standing out amidst the market downturn.

At the time of writing, Bitcoin and many other cryptos are showing candlesticks red on their daily chart. In contrast, Ethereum is in green, experiencing a modest gain of just over 1 percent. This difference in performance highlights the unique market dynamics and investor sentiment surrounding Ethereum.

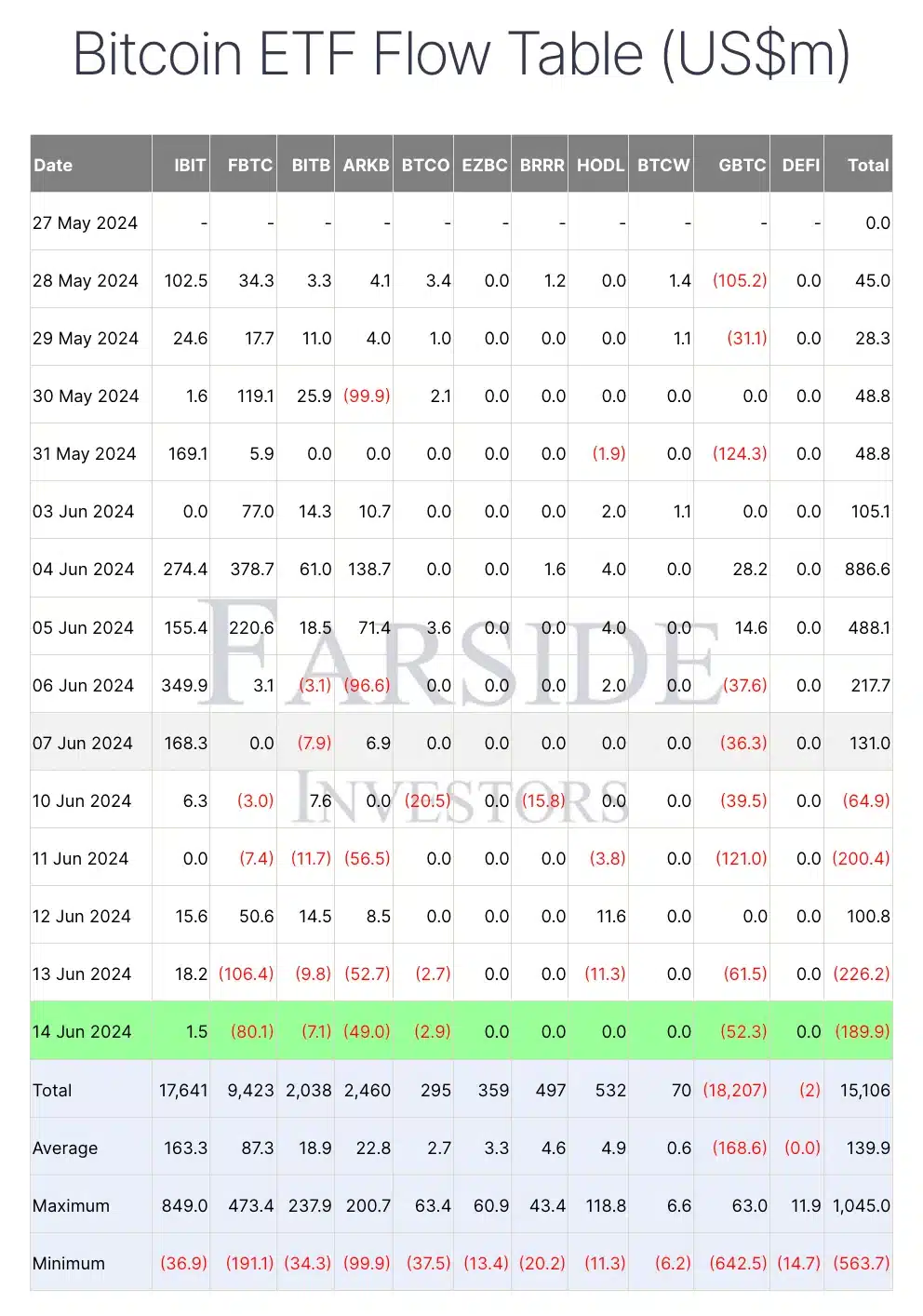

Additionally, a recent report by Farside Investors highlighted that spot BTC ETFs had a two-day streak outflows on June 13 and 14, for a total of US$416.1 million.

This trend indicates a shift in investor focus and confidence, potentially paving the way for an Ethereum ETF to attract market interest once approved. [st]