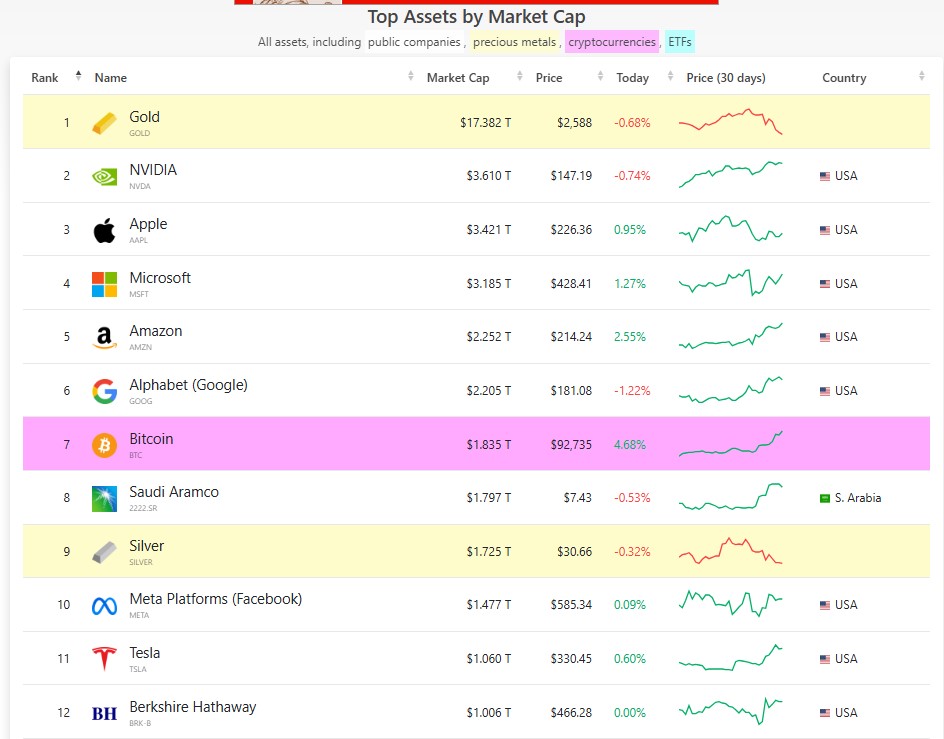

BTC sets another record high. On Wednesday (11/13/2024) at 23.14 WIB, this number one crypto reached ATH at US$93,471, surpassing market capitalization Saudi Aramco.

Trends bullish Bitcoin continues to strengthen after the US Presidential Election with the victory of the pro-crypto Trump, including the appointment of Elon Musk to lead Department of Government Efficiency (DOGE).

Bullish This BTC is also reflected in the inflow of funds to Spot Bitcoin ETF which reached more than US$1 billion in one day for the second time on Monday, November 11.

Based on Coinglass data, the total net inflow of funds in this investment instrument in the US on that day reached US$1.12 billion with net purchases of 28.2 million Bitcoin, which was the second largest inflow of funds since the launch of the ETF in January.

Reku: BTC Rally Can Still Continue, If…

This positive momentum also supported the surge in Bitcoin prices, which previously set a new record by breaking US$80,000 for the first time, then continued above US$90 thousand on Wednesday before midnight.

According to analysts RekuFahmi Almuttaqin, in his recent written statement, said this development was in line with market expectations.

“Bitcoin is currently entering a new price exploration phase, aka entering previously uncharted territory. If selling pressure remains under control, then the rally has the potential to continue. We observed significant buying from large investors in the last week, indicating the initial phase of a major rally in the trend bullish This. Positive potential for the market crypto “In general, it is still open,” said Fahmi confidently.

In the market crypto derivativesinvestors had anticipated a correction last weekend, but Bitcoin instead continued to strengthen, setting a new record.

“This suggests that the current rally is more solid than investors expected. “If the rally continues without long consolidation, there is a chance of a big rally at the end of the year like what happened in 2017,” he added.

Bitcoin Getting Stronger as Digital Gold? This Surge is Proof!

Trends Bullish US Stocks

The US stock market has also strengthened, with the S&P 500 index rising nearly 5 percent in the past week. However, investors remain alert to the potential for overheating which could trigger a correction, similar to market dynamics crypto.

One of the indicators, Shiller PE Ratiowhich measures stock valuations against 10-year average earnings adjusted for inflation, had touched 38.29. Although it doesn't guarantee a trend bearishthis overheating situation makes investors more careful in managing their portfolios.

Amid this positive trend, both novice and experienced investors have the opportunity to strengthen asset allocation in the market crypto and US stocks.

“Investors need to manage their portfolios well to maximize potential profits and reduce risks. With market conditions bullishrisk ratio/rewards “is more profitable, provides opportunities for novice investors to learn more comfortably,” he explained.

For investors who pay more attention to fundamentals, crypto assets with large capitalization could be the main choice.

“For example, through the Packs feature in Reku, investors can diversify their portfolio crypto with various assets blue-chip in one click. For beginners in US stocks, the US Starter Packs feature provides top performing indices, including S&P 500allowing investors to continue to achieve positive growth with measurable risks,” he concluded. [ps]