Fetch.ai (FET) has taken a monumental step in the artificial intelligence (AI) sector, marking a significant transformation in its identity and market positioning.

With the merger of Ocean Protocol (OCEAN) and SingularityNET (AGIX) into Fetch.ai, the collective entity has rebranded as Artificial Superintelligent Alliance (ASI), which continues to trade under ticker FET during this transition period.

Market Impact and Investor Response

Based on the report BeinCryptoannouncement of merger or merger This has set the stage for a significant market move. The price of FET, previously driven by Fetch.ai activity alone, now represents the combined power and potential of ASI.

FET's market capitalization has soared to nearly US$3 billion, placing it as the second largest asset in the market. AI tokena remarkable achievement that underscores the importance of this merger.

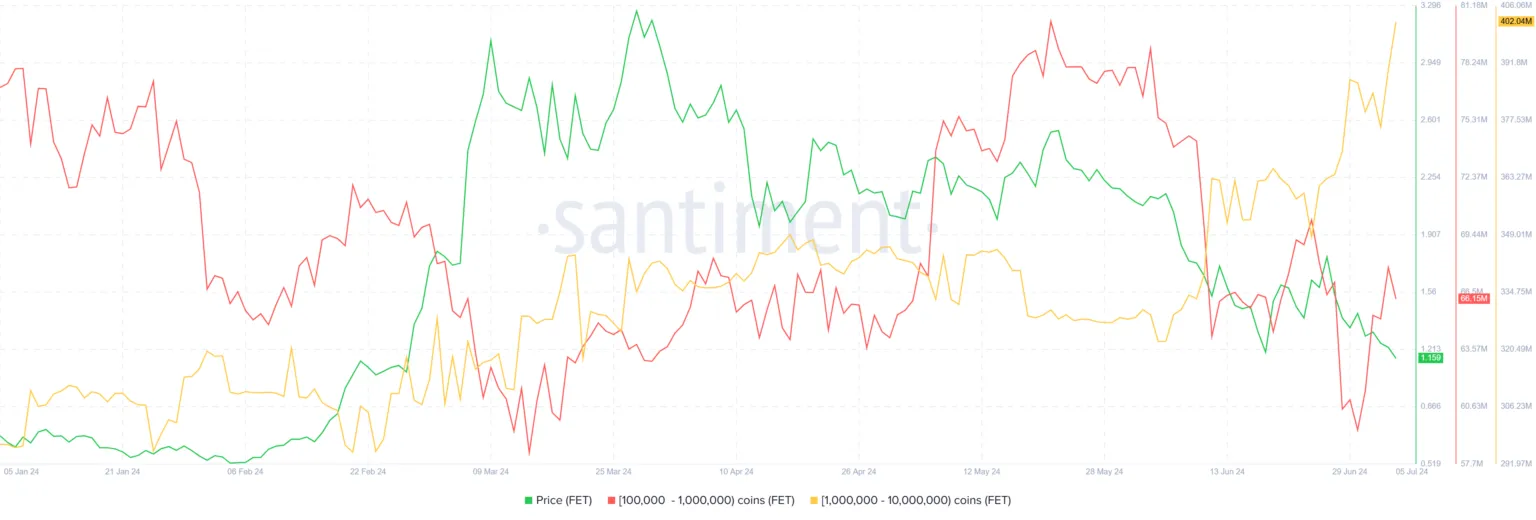

Institutional investors, or whale, have observed the profit opportunities presented by this development.

In just a week, addresses holding between 100,000 and 10 million FET accumulated more than 62 million FET tokens, worth nearly $73 million.

This strategic accumulation is a clear indicator of the anticipated bullish run after the merger, reflecting confidence in ASI's future prospects.

Retail Investor Sentiment and Social Media Buzz

The optimism surrounding Fetch.ai and its new identity is not limited to large-scale investors. Retail investors are also showing significant interest, driven by the positive sentiment echoed across various platform social media.

Fetch.ai has seen a spike in mentions and discussions, highlighting the sentiment bullish which is widespread in the community.

This collective enthusiasm is rooted in the potential seen in the future development and market position of breast milk.

The hope is that this merger will be a catalyst for a substantial price surge, benefiting all levels of investors who have placed their trust in FET.

FET Price Dynamics: Exiting Consolidation

Despite the optimistic outlook, Fetch.ai's price movements have faced challenges from broader market conditions.

Currently, FET is undergoing a period of consolidation, trading between $1.7 and $1.0 for almost a month. This phase of price stagnation is expected to continue until the merger is fully completed.

However, the successful completion of the merger is anticipated to inject momentum bullish new into FET, which could potentially take it out of this consolidation range.

Temporary altcoin has shown some signs of potential downside, approaching the lower bound of US$1.0, the scenario bearish this remains a risk but not a certainty. [st]