This may be a good position for crypto lovers, where the price of BTC in 2025 is predicted to reach above US$100 thousand. Traders Veteran from the US, Peter Brandt, is also confident that he can reach US$150 thousand.

2025 is still 53 days away. However, as Bitcoin continues to set new records reflecting high demand from the market, a number of new predictions about BTC prices in the next year are becoming increasingly popular.

Gate: US$144,722 until 2030

One of the 2025 BTC price forecasts comes from Gate, crypto exchange pretty big right now. Reported on Saturday (9/11/2025), they predicted that the price of BTC in 2025 could reach US$114 thousand.

“Bitcoin could reach up to US$144,722 from now to 2030. Potential ROI from purchasing Bitcoin at the current price of US$75,895 (+90 percent),” call them, implying that by 2025 the BTC price range could be in that range.

That's assuming Bitcoin reaches levels that is predicted. Additionally, Bitcoin's all-time high was recorded at US$76,870 early Friday morning, with a recent price movement of -0.31 percent in the last 24 hours and a weekly gain of +9.37 percent.

Peter Brandt: BTC Price 2025, US$150 Thousand

Such Bitcoin price predictions may seem far-fetched, because they lack strong arguments. But analysis of traders this veteran, Peter Brandt, may be more convincing to the public.

“BTC price is now at the peak of the cycle halving market bull which should be in the range of US$130 thousand to US$150 thousand in August or September. “I do measure cycles in a different way than other people,” he wrote at X, Thursday (7/11/2024).

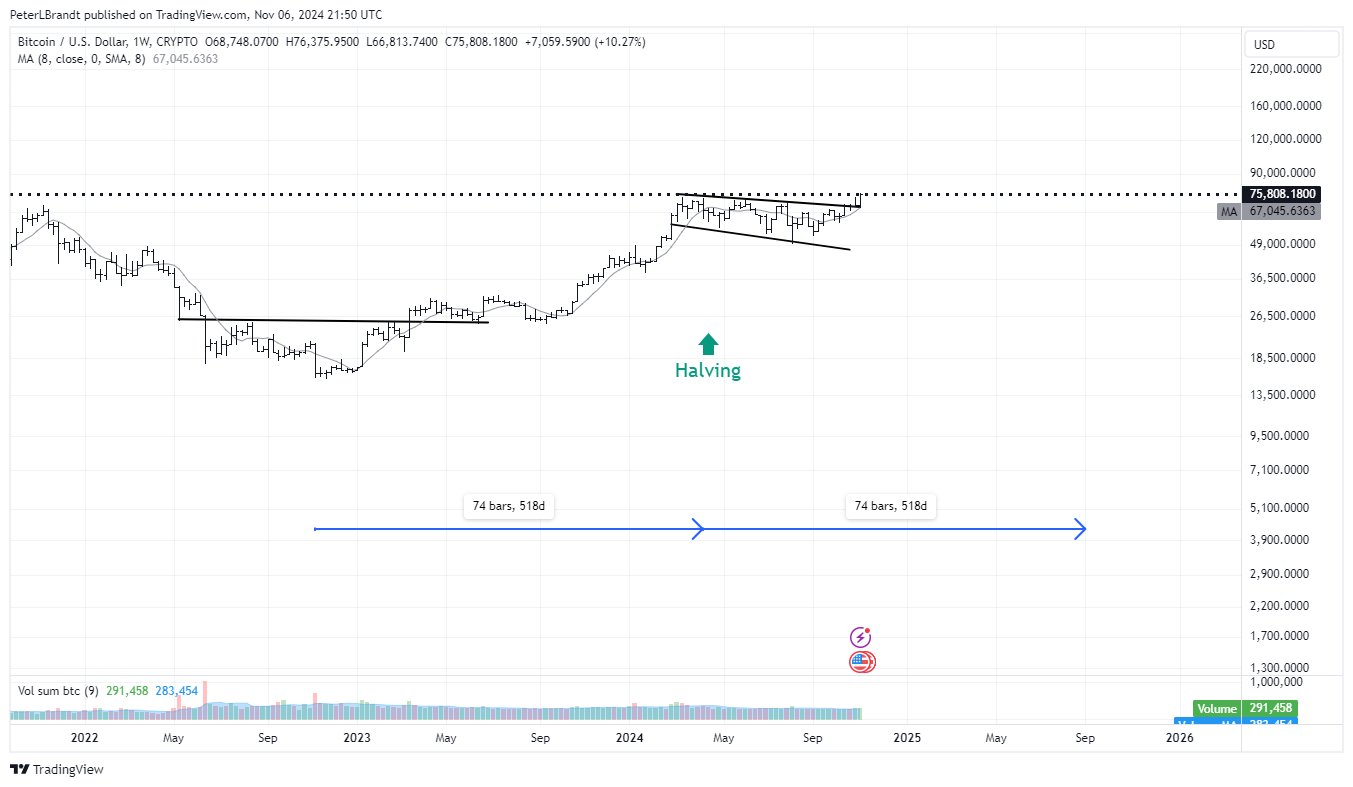

Brandt's analysis is based on cyclical patterns halving Bitcoin as seen from its history. In a chart showing Bitcoin's price movement from early 2022 to a forecast year of 2026, he highlights two key periods, each 518 days long. These two periods are considered critical phases in Bitcoin marketshows the cyclical pattern of its price movements.

Important technical patterns what is visible in the graph is a break from the widening wedge shape. This pattern, with lines support And resistance which is further away, indicating that market volatility increases as prices reach higher and higher highs and lower lows.

If it breaks through this pattern, it is considered a signal bullish the strong one. He explained a complete analysis of the cycle in full in this June 2024 article.

Previously on February 27, 2024 he predicts that the price of BTC in 2025 could reach US$120 thousand to US$200 thousand by the end of August or September. With Brandt's latest statement, this indicates an assumption bullish still remain.

On October 26, 2024, Ecoinometrics predict that the price of Bitcoin (BTC) could reach six digits by the end of 2025, with target US$130,000, if market conditions remain favorable. The main factors underlying this prediction include activity on-chain stability, strong risk asset momentum, and BTC's ability to maintain prices above the US$65,000 threshold. The Ecoinometrics analysis model estimates returns BTC annualization could reach 148 percent in a sweet scenario.

However, there is a potential risk of a decline of up to 26 percent in the worst conditions. Ecoinometrics also notes that BTC moves in tandem with the NASDAQ 100, showing a positive correlation with the US stock market, which could benefit BTC prices if there is a rise in the stock exchange. Apart from that, growth in the US money supply (M2) is also influencing the market, although it is not yet equivalent to the spike during the pandemic.

Despite the challenges, BTC is considered to still have potential as a hedge against fiat depreciation. If momentum bullish continues and global monetary policy stabilizes, BTC has the opportunity to reach its six-digit price target in 2025.

Bitcoin price predictions 2025 indicate the potential for major changes for this digital asset. After nine months of stability around US$60,000, analysts predict the first quarter of 2025 as a critical period.

Markus Thielen of 10x Research on October 11, 2024 stateBitcoin has the potential to experience significant spikes or drops. Changes in global economic policy, especially from the Fed, could affect prices, especially if US bond yields continue to rise. On the other hand, if the Fed lowers interest rates while keeping the economy strong, Bitcoin prices may soar. [ps]