Geopolitical tension again shook the crypto market. Israeli air strike to Iran Some time ago triggered sharp correction at the price of Bitcoin. In a short time, the price of BTC had jumped freely to the range of US $ 103,000, before finally recovering to US $ 105,000.

The movement of Bitcoin prices that are so fast and extreme makes a lot trader and investors wonder: is this just retracement Meanwhile, or precisely the beginning of a deeper correction?

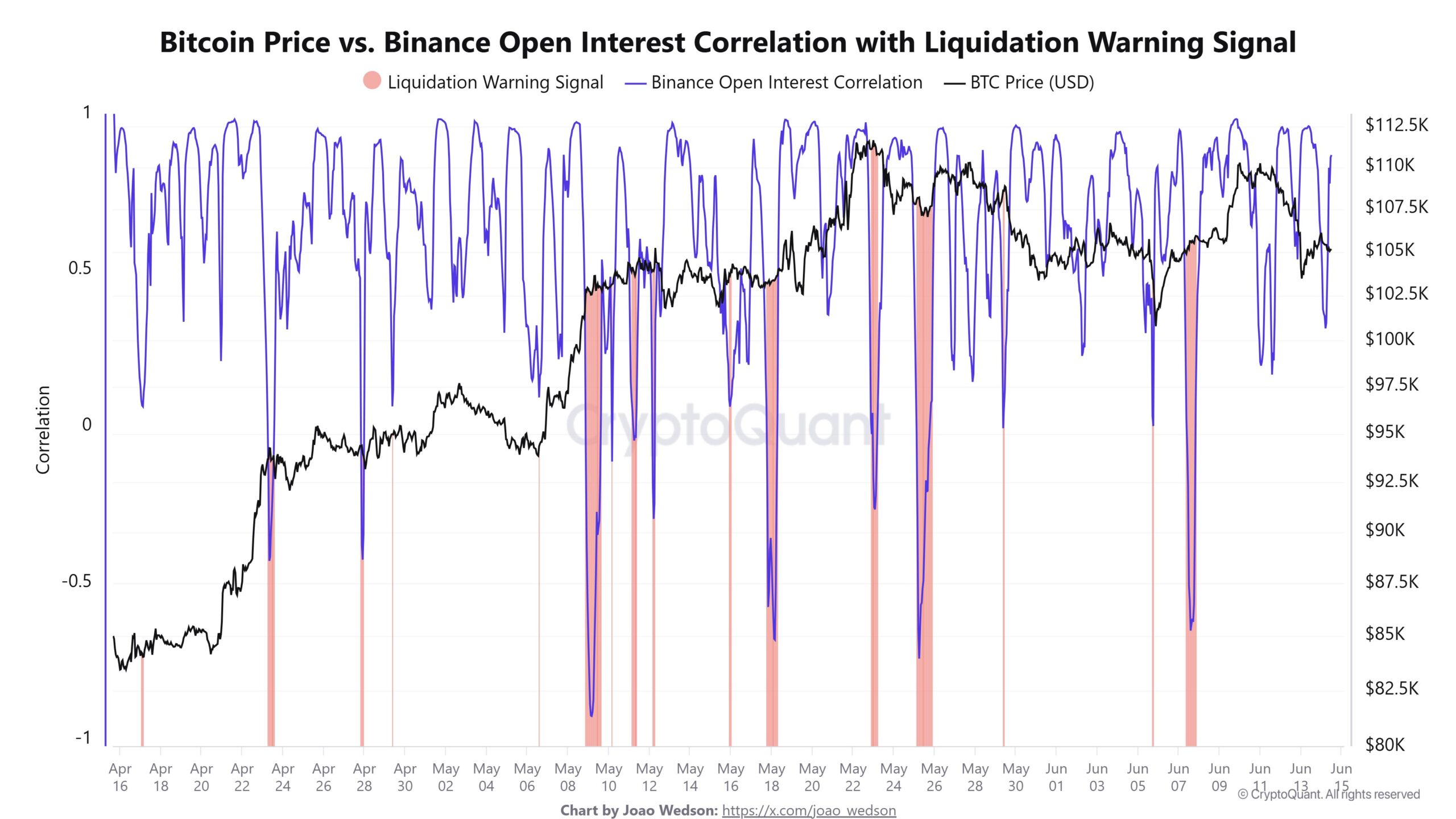

Binance Correlation Open interest So the key signal

One indicator that attracts attention comes from Binance. Joao Wedson, Analyst On-chain as well as Alphractal CEO, disclose in his analysis on Saturday (6/14) that the correlation between Open interest (OI) in Binance and Bitcoin prices are currently sending signals to watch out for.

According to Wedson, the correlation is now approaching level which is very critical and can be a sign that Crypto Market and Bitcoin is preparing to enter the high volatility phase.

“When the correlation drops significantly (≤ 0.1), this often indicates the opposite behavior between price and Open interest (OI). Historically, this condition is often the predecessor of a large surge in volatility at the price of Bitcoin, “he explained.

This low correlation shows that many trader is opening a position with Leverage which is contrary to direction Price trend BTC. When prices move sharply against their position, the risk of mass liquidation increases.

Wedson also stressed the importance of observing this correlation movement carefully, given the potential for large movements that could occur in the near future.

“Beware of the decline in the OI correlation in Binance – that is a warning for the potential for liquidation and large price movements that might occur!” he added.

Bitcoin dominance strengthens, Altcoin Began to be abandoned

In addition to technical signals from binance, data On-chain also shows a change in strategy from investors, in particular Whale. Latest Bitcoin Trends shows that the flow of capital begins to turn around towards Bitcoin, while interest in Altcoin slowly decreases.

This shift strengthens the narrative that investors now prefer Crypto Assets which is safer and liquid. In global situations that are full of uncertainty, Bitcoin is again considered the main choice for protection of short and long -term values.

This condition is further strengthened by a combination of increasing Bitcoin dominance and decreased correlation Open interest (OI) in Binance. Both of these indicators become signals that indicate the potential for large price movements.

With geopolitical pressure, the crypto market is now in a very vulnerable phase of the surge in volatility. For Para traderthis is a crucial time to be more alert, monitor indicators strictly, and manage disciplined risks. [dp]