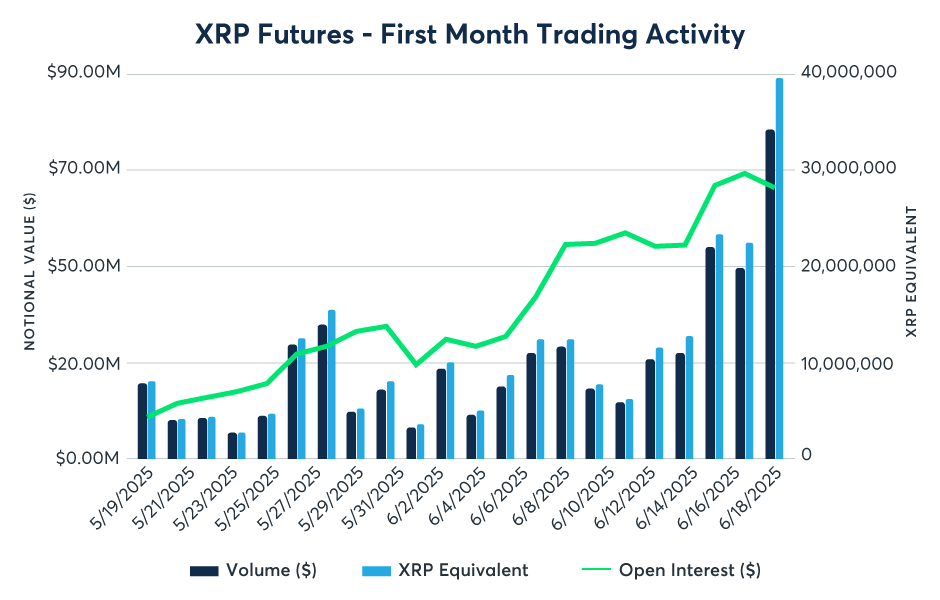

Interest in XRP continues to show a positive trend, reflected in product performance XRP Futures The CME Group has recorded a record of trading volume since it was first launched.

Volume XRP Futures Translucent US $ 542 million

Based on report CME Group on (23/06), Products XRP Futures And Micro XRP Futures Successfully posted a transaction volume of more than US $ 500 million since it was launched last May.

“Since it was launched, XRP Futures has recorded a total trading volume of US $ 542 million. Interestingly, 45 percent of these volumes originated from outside North America, “as stated in the report.

This growth is classified as explosive. On the first day of launch alone, the transaction volume reached US $ 19 million. In the next four weeks, the number jumped up to 28 times – showing the high interest investor against this asset.

CME Group offers XRP derivative contracts in two versions: micro and regular sizes. Both are completed in cash and refer to Cme cf xrp-dollar reference rate.

Interestingly, almost half of the total trading volume comes from outside the US and strengthens the signal that the attractiveness of XRP is global and is not limited to domestic markets.

Regulations are increasingly supportive, XRP is increasingly glanced

Growth momentum XRP Futures cannot be separated from the development of regulations that are increasingly conducive in the US. Two crypto exchange Another large, coinbase derivatives and bitnomials, have Pocket permission official to trade XRP futures contracts.

This step is possible after SEC decided to pull out the appeal legal case against Ripple Labs. The decision opened the way for institutions to offer XRP derivative products that were regulated under the supervision of the CFTC Commission.

Ripple paid IDR 750 billion to end the SEC lawsuit questions XRP

Based on previous Crypto ETF products, the existence market Futures which is regulated into one of the important references for SEC in evaluating and considering submissions Crypto Spot ETF like XRP.

Therefore, the appearance of the product XRP Futures in platform Large like CME, Coinbase derivatives, and also bitnomials further strengthen the opportunity for the approval of Ripple ETF in the near future.

XRP Spot ETF In front of your eyes?

As is XRP Futures which are regulated in CME, Coinbase Derivatives, and Bitnomials, the position of XRP is now more structurally parallel to BTC and ETH. This regulatory support strengthens the belief that the product Ripple Spot ETF Just waiting for time.

ETF Senior Bloomberg analyst, James Seyffart and also Eric Balchunas, even raised the opportunity XRP Spot ETF in 2025, exceeding prediction They were previously at 85 percent.

“Eric Balchunas and I raise the opportunity for approval for most of the submissions Crypto Spot ETF to 90 percent or more. Direct involvement from SEC is a very positive signal in our opinion, ” write Seyffart at X, Sunday (06/21/2025).

The entry of ripples into the ETF radar is not only a positive signal for investors, but also marks an important milestone in the development of the crypto industry. If the XRP ETF gets the green light from SEC, this has the potential to open the capital flow institutional on a large scale. [dp]