Although many parties assume that the trend of the Bitcoin market is currently entering the phase bearishwith the price of BTC which dropped to the range of US $ 113,000 to US $ 114,000 after nuclear threat Trump, the latest data actually shows the opposite.

Analysts believe that even though there is a short -term correction, BTC prices still have the potential to rise further. The volume of binance transactions and increased liquidity of The Fed is considered as the main catalyst that can encourage Bitcoin to continue the trend bullish.

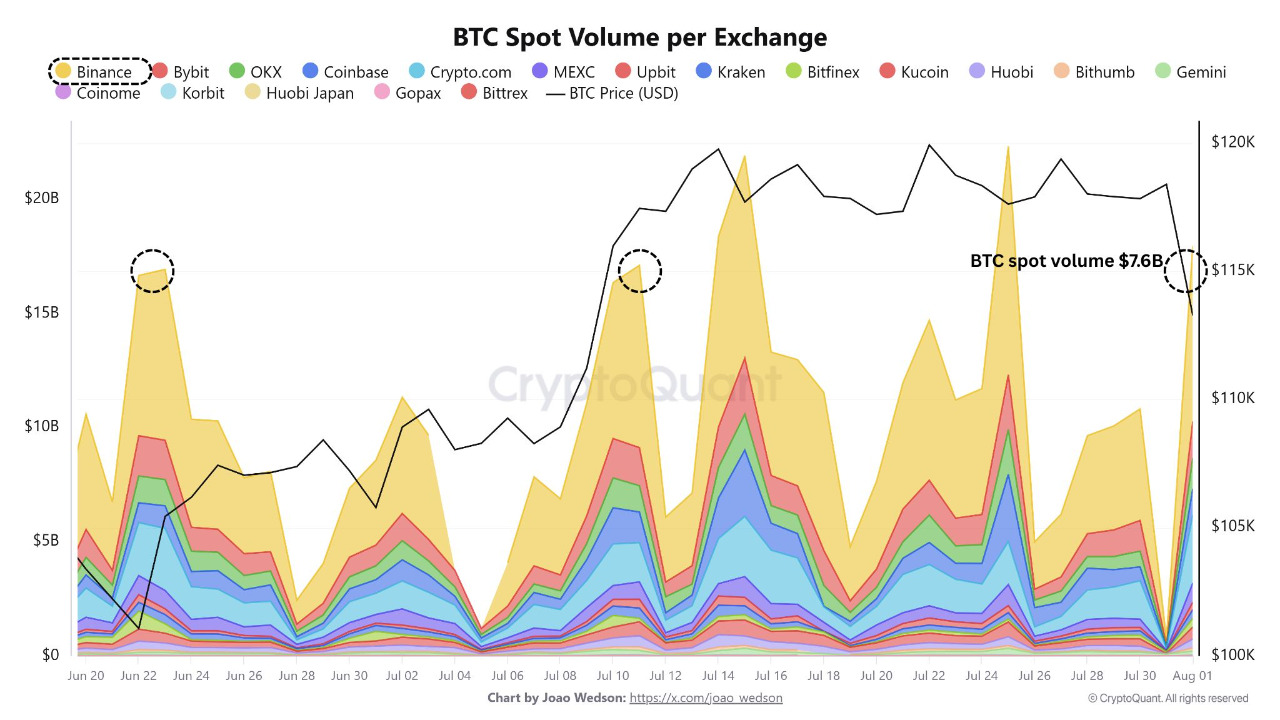

Volume Spot Bitcoin in Binance jumped sharply

In a analysis in platform Cryptoquant, analyst On-chain AMR Taha, on Sunday (03/08/2025), building an argument bullish For the price of Bitcoin after the latest shift in the market and a wider macro dynamics.

Taha highlighted the major changes in the volume Spot Bitcoin in Binance, Exchange Crypto biggest In the world based on trade volume, which according to him can be an important indicator for the potential increase in BTC prices.

“On August 1, 2025, Binance recorded volume Spot The daily BTC is more than US $ 7.6 billion, marking one of the biggest spikes in the last few weeks, “he explained.

This sharp surge occurred together with a decrease in the price of Bitcoin from level US $ 118,000 to around US $ 113,000, indicates an increase in volatility and trader which seems to be preparing for a position.

Historically, a surge in volume like this is often associated with the lowest local point or changes in the direction of the trend. Large entry flow usually indicates aggressive accumulation by investor institutionalwho predict rebound and can be a catalyst bullish.

“The implication of this increase has the potential bullish: request Spot Increasing – especially concentrated in Binance – can act as the main indicator of the existence of the support of the incoming price and the rising pressure that reappears, “he added.

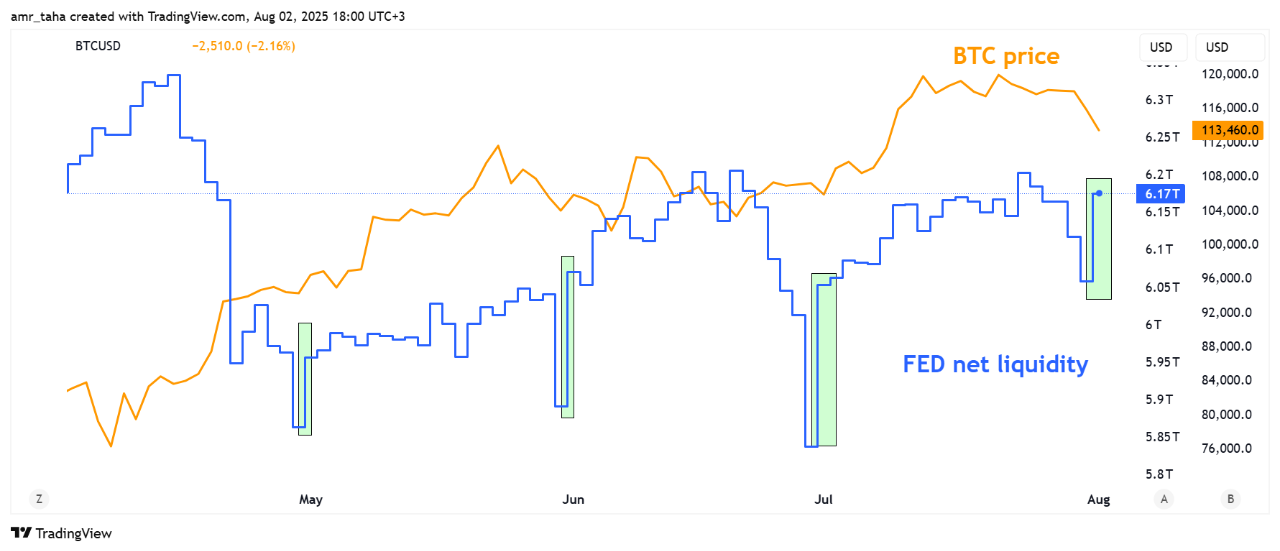

The Fed records an increase in clean liquidity

Apart from the volume side, Taha also highlighted macroeconomic factors that influence, namely the surge of clean liquidity The Fed which rose significantly from US $ 6 trillion to US $ 6.17 trillion. According to him, this is an important macro factor for risk assets such as bitcoin.

“Expansion of clean liquidity means more cash circulating in the financial system, which can flow to stocks, crypto, and other risk assets,” he said.

The spike in the Fed’s clean liquidity often coincides with shifts trend bullish In the market, as seen at the end of 2023 and early 2024, which certainly affects the Bitcoin market.

Taha concluded that the combination of volume surge Spot Bitcoin in binance and the increase in the Fed’s net liquidity can create opportunities for the continuation of positive trends for BTC price movements.

Overall, even though the current trend is visible bearishstructure bullish Still very strong. Although there is Term correction shortinstitutional support and macroeconomic factors that support still provide potential positive movements in the future. [dp]

Disclaimer: All content published in Blockchainmedia.idboth in the form of news articles, analysis, opinions, interviews, special coverage, paid articles (paid content), as well as sponsorship articles (sponsored content), provided solely for public information and education purposes regarding blockchain technology, crypto assets, and related sectors. Although we are trying to ensure the accuracy and relevance of each content, we do not provide guarantees for the completeness, timeliness, or the reliability of the data and opinions contained. Content is informative and cannot be considered as investment advice, trade recommendations, or legal suggestions in any form. Every financial decision taken based on information from this site is entirely the responsibility of the reader. Blockchainmedia.id not responsible for direct or indirect losses, data loss, or other damage arising from the use of information on this site. The reader is strongly advised to conduct independent verification, additional research, and consult with professional financial advisors before making decisions involving financial risks.