Based on indicators Pi Cycle TopBitcoin's peak price has not yet been formed. According to Rekt Capital, this situation is an accumulation opportunity.

More about Indicators Pi Cycle Top Besides Bitcoin Peak Price Marker

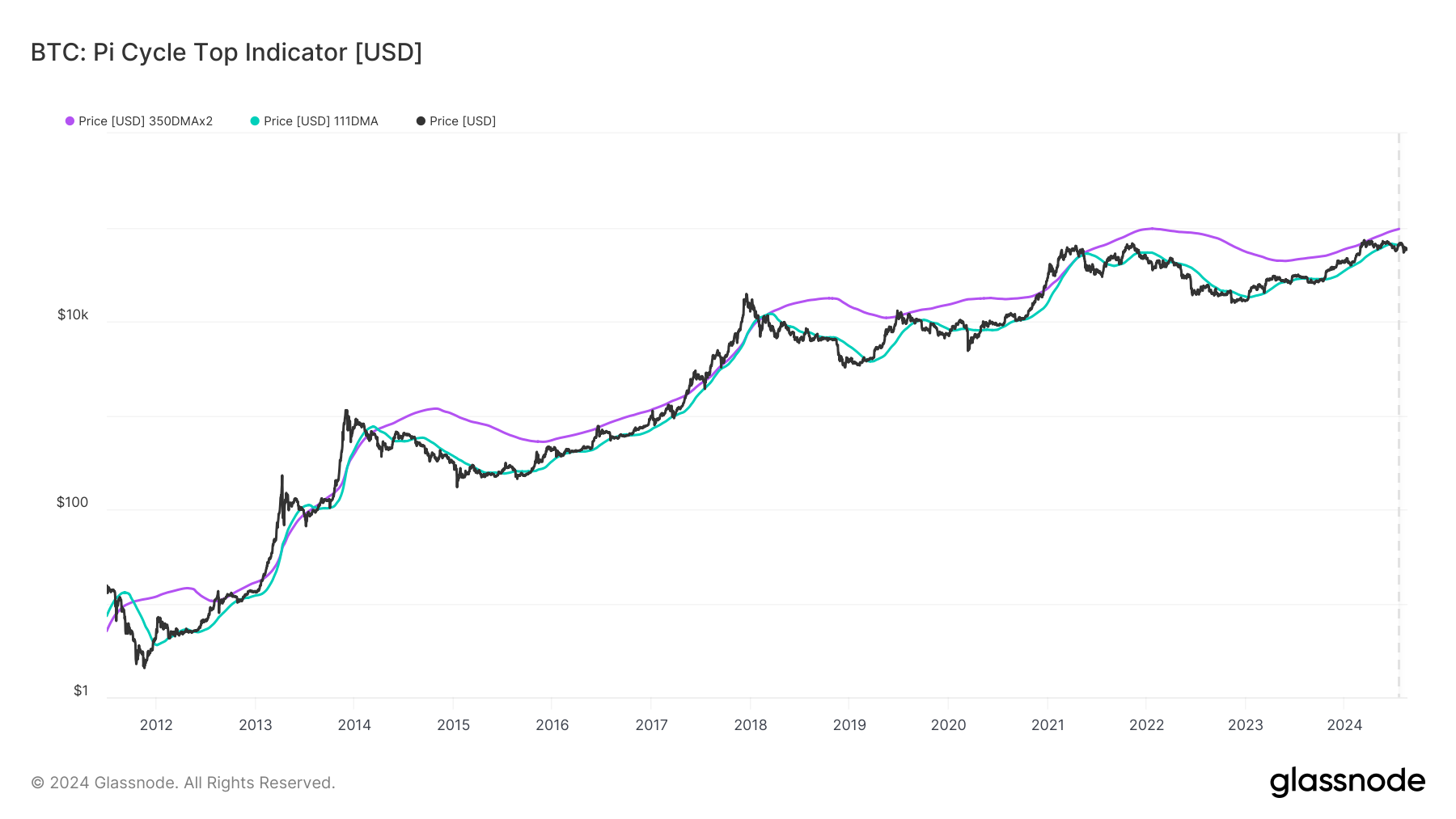

The Pi Cycle Top indicator is a tool used to predict Bitcoin's peak price by observing the intersection (crossover) between two moving averages (moving averages) certain, namely the 111-day moving average (111 SMA) and a multiple of two of the 350-day moving average (350 SMA x 2) of the Bitcoin price.

This indicator is designed to show when Bitcoin becomes very Overheat or too expensive aka saturated buying (overbought), which is marked when the shorter moving average (111 SMA) reaches the same level as the longer moving average (350 SMA x 2).

In other words, if the 111 SMA is slanting from top to bottom, crossing the 350 SMA x 2, it is a sign that a Bitcoin top has been formed and the price has historically tended to correct deeply.

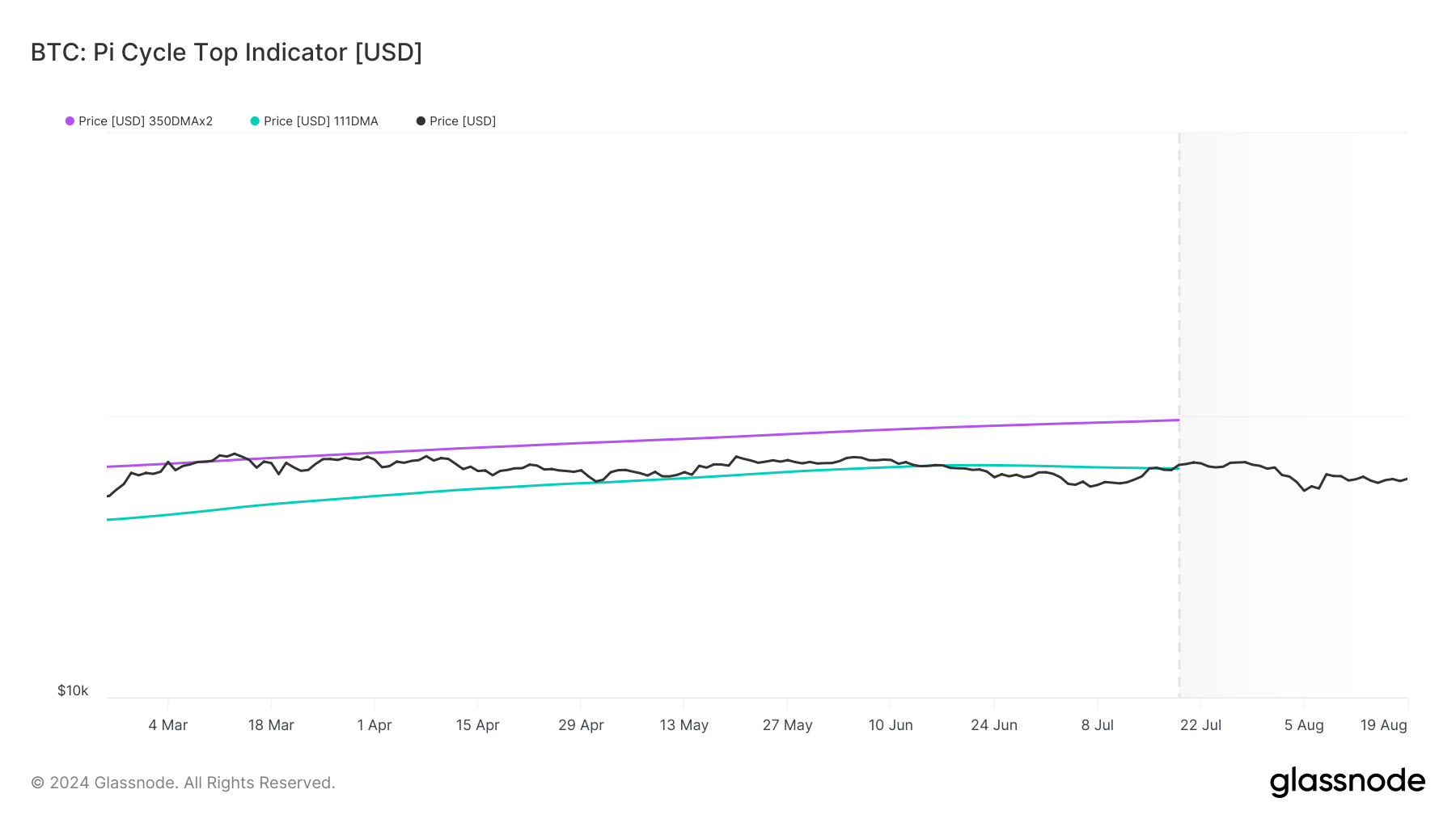

So far, Bitcoin's ATH occurred on March 14, 2024, which occurred before Halvingin the range of US$73,750 based on data from Coinmarketcap.

Two pictures Pi Cycle Top indicator above, each explains the data crossover between two Moving Average all time, and the current BTC price is below the 111 SMA which is interpreted as an accumulation opportunity. The 111 SMA is marked with a turquoise line and the 350 SMA x 2 is purple.

This indicator is popular among trader and analysts thanks to development by Philip Swift, Managing Director of Bitcoin Magazine Pro who is also the Founder and CEO of Trendstorm.

Moreover, this indicator is famous for its ability to identify important moments when the Bitcoin price approaches the highest peak in its cycle, aka all time high (ATH).

When these two averages intersect, it is usually a sign that the market is reaching its peak. At this point, many trader will consider selling their holdings to avoid the price decline that usually occurs after a market peak is reached.

However, currently, these two moving averages are moving further away from each other (diverging), indicating that the market is still far from the next Bitcoin peak price.

This indicates that the market is in an accumulation phase, where prices tend to stabilize and offer profitable buying opportunities before the next uptrend occurs.

This was also confirmed by Rekt Capital recently on their YouTube channel, that the indicator is currently showing a divergence picture which is a sign of accumulation action, because the Bitcoin price is below the 111 SMA.

“But right now, we are not experiencing convergence, but rather divergence which is driving the potential crossover…so, when BTC price is below (111 SMA) currently, it can be read as a buying opportunity,” Rekt Capital explained.

The selection of the 111-day (111 SMA) and a double of the 350-day moving average (350 SMA x 2) in the Pi Cycle Top indicator is based on historical analysis showing consistent patterns in Bitcoin price movements over market cycles.

The 111-day moving average was chosen because it represents a short enough time period to capture rapid price changes, yet still provides a more stable picture of the trend than shorter periods.

On the other hand, the 350-day moving average represents a longer-term trend spanning nearly an entire year, which is important for understanding broader, longer-term price movements. By multiplying the 350-day moving average by two, this indicator creates an upper bound that historically reflects the level at which Bitcoin has often been considered Overheat or too expensive aka Bitcoin's peak price position.

The intersection of the 111 SMA and the 350 SMA x 2 signals the moment when the short-term trend (111 SMA) meets the broader long-term trend (350 SMA x 2). When this happens, it indicates that the market is at a critical juncture where price may have peaked. This combination has proven effective in predicting Bitcoin peak prices in the past, making it a useful tool for traders. trader and analysts.

Regarding that, crypto analyst from Real Vision opined on his X accountthat the price of Bitcoin could rise 200 percent and reach US$100 thousand by 2025. [ps]