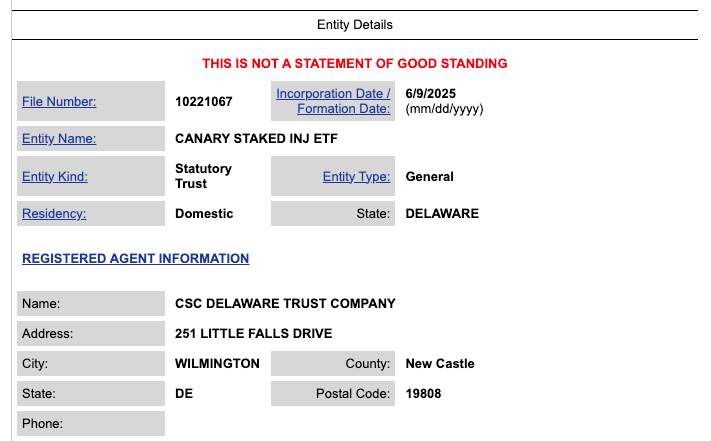

Canary Capital, an increasingly active asset manager in the crypto sector, started the first step to present the product investment Crypto based token Injective (INJ). This company was recorded formed an entity named Canary Stakened Inj ETF In the state of Delaware, USA.

The official document shows that Trust the established On Monday, June 9 – the first step that was commonly made before applying for the product Exchange-traded fund (ETF) to the US Securities and Exchange Commission (SEC).

Brave steps canary capital

The steps taken by Canary Capital are quite brave. In contrast to many large asset managers who tend to focus on Altcoin Mapan like XRP, Sol, or ETH, Canary actually chose to target newer coins and not yet widely known.

Previously, in April, they also had submit ETF based on TRX. The product is designed with a scheme Staking to produce Yield– Strategy that is now re -used on Injective (INJ) -based products. That is, some coins are likely to be locked on the network.

Not only that, Canary Capital also recorded several times to submit ETF for Altcoin Other relatively new in the market, such as Sui, to Altcoin which is quite unique, namely Pengu Etf.

This approach shows the canary strategy consistency in finding opportunities from new crypto assets that have the potential to grow in line with the increase in market interest in the product Staking And Real-Yield BASED BLOCKCHAIN.

Positive market sentiment, the price of the Inj strengthened

News of formation Trust This has a big impact. Based on data From Coinmarketcap, price Token Inj rose more than 4 percent in the last 24 hours, as news was shared through the official Injective account at X. We weekly, the price of the Inj has jumped more than 10 percent, supported by an increase in transaction activities on its network.

This momentum puts injective in the spotlight, mainly because of its unique position as a blockchain Layer-1 which targets the integration of artificial intelligence as well Tokenisasi RWA like stock. These two sectors are on the rise in the crypto market.

With the increasing interest of institutional investors towards the model Staking And Tokenisasi, the ETF plan of Canary Capital can be an important starting point in expanding the adoption of blockchain injectives in the global market. [dp]