Spot Bitcoin ETF Options which just got the green light in the US, could be interpreted as Bitcoin's next price catalyst.

Securities and Exchange Commission (SEC) The United States (US) has just given the green light to the New York Stock Exchange (NYSE) and CBOE to startlistings and trading derivative products Spot Bitcoin ETF Options. This decision is a significant step in increasing the diversity of investment instruments with large crypto values, which can be accessed by investors and tradersboth by individuals and institutions in Uncle Sam's country.

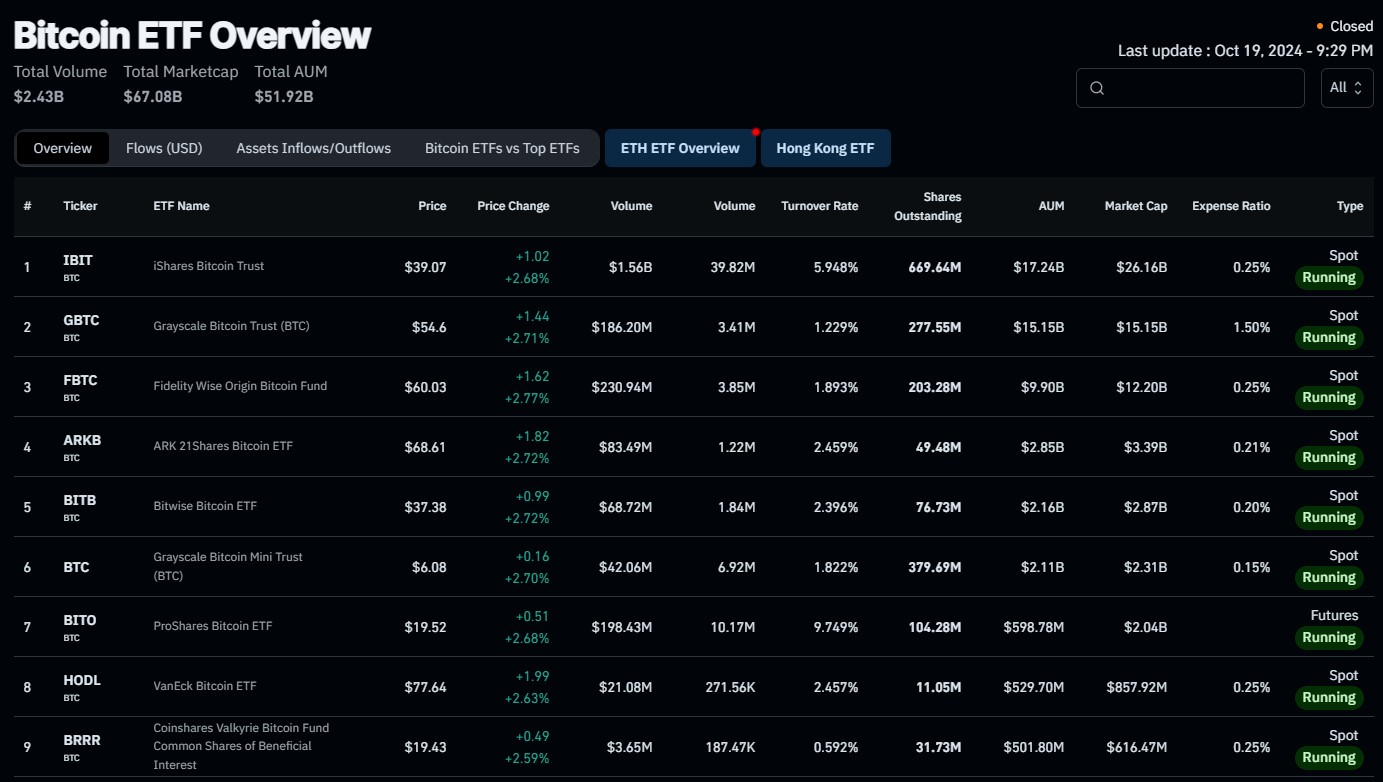

For NYSE, SEC allow product options against the following ETFs: Fidelity Wise Origin Bitcoin Fund, ARK21Shares Bitcoin ETF, Invesco Galaxy Bitcoin ETF, Franklin Bitcoin ETF, VanEck Bitcoin Trust, WisdomTree Bitcoin Fund, Grayscale Bitcoin Trust, Grayscale Bitcoin Mini Trust, Bitwise Bitcoin ETF, iShares Bitcoin Trust ETF, and Valkyrie Bitcoin Fund.

Meanwhile, the CBOE are: Fidelity Wise Origin Bitcoin Fund, ARK21Shares Bitcoin ETF, Invesco Galaxy Bitcoin ETF, Franklin Bitcoin ETF, VanEck Bitcoin Trust, WisdomTree Bitcoin Fund, Grayscale Bitcoin Trust BTC, Bitwise Bitcoin ETF, iShares Bitcoin Trust ETF, and Valkyrie Bitcoin Fund , according to the filing uploaded on Friday (18/10/2024).

The SEC agreed Spot Bitcoin ETF in January 2024. The agency first approved the product listing options to iShares Bitcoin Trust (IBIT) made by BlackRock on the Nasdaq stock exchange in September 2024.

Spot Bitcoin ETF Options can be interpreted as a Bitcoin price catalyst that is on the horizon. Moreover, the US is the largest financial and securities market in the world, including the ETF market and regulatedso the level of liquidity is very high.

However, quite a few of us are still confused about what it actually is Spot Bitcoin ETF Options That. This article will discuss it in a complete but simple way.

What's that Spot Bitcoin?

Before we discuss matters options ETF value, we first return to the core understanding of Spot Bitcoin.

Spot Bitcoin refers to BTC assets that are bought or sold directly at the current price in the market. The transaction is completed immediately, and Bitcoin ownership immediately changes hands.

The analogy is buying Spot can be likened to buying fresh vegetables at the market. You go to the market, see the prices of the vegetables you want, and pay to take them home. Once the transaction is complete, the vegetables are immediately yours. Yes, as the term says, on-the-spotyou get the item directly on the spot.

Suppose an investor wants to buy 1 Bitcoin at a price spots currently worth US$65,000 in a crypto exchange aka crypto exchange. The investor made a direct purchase of 1 Bitcoin using stablecoins USDT. Once the transaction is complete, the Bitcoin immediately becomes the property of the investor, and they can store it in their personal digital wallet, outside of the digital wallet on the crypto exchange. The same thing will happen if the investor wants to sell it.

In Indonesia, the term spots translated as “physical”, because trading of commodities and goods before electronic facilities existed, was carried out physically in the market directly. That is why crypto exchange in Indonesia it is called Crypto Asset Physical Trader (PFAK) in their relationship as members of the CFX crypto asset derivatives exchange. In Indonesia crypto categorized as commodity assets or simply called “crypto assets”.

What's that Spot Bitcoin ETF?

If Spot Bitcoin is a direct BTC purchase, then Spot Bitcoin Exchange-Traded Fund (ETF) is a way to buy BTC assets indirectly, which are represented by certain companies (ETF issuers) in the form of shares traded on stock exchanges.

ETFs itself is similar to a mutual fund, which allows investors to purchase a collection of assets in one investment product. In Indonesia, we know it as mutual funds ETFs. However, the main difference is that ETFs traded on a stock exchange like shares, so investors can buy and sell them throughout the day at varying prices, whereas mutual funds are usually traded only once a day after the market closes at a price determined at that time.

In other words, Spot Bitcoin ETFs is an exchange-traded fund that tracks (tracking) price of Bitcoin in the market spots directly. By purchasing shares in this ETF, investors gain exposure to Bitcoin price movements without having to buy Bitcoin directly.

Buying Bitcoin Spot ETF shares is analogous to buying concert tickets. You don't need to own the band or artist directly. But with a ticket, you get access to enjoy their performance. Similarly, by buying ETF shares, you do not own Bitcoin directly, but you can benefit from its price movements.

For example a Spot Bitcoin ETF traded on the Nasdaq stock exchange under the symbol “IBIT.” An investor buys 10 shares of this ETF at US$40 per share. If the price of Bitcoin rises to US$60,000, the value of ETF shares will also likely increase. In this case, underlying value from the ETF it is the movement of BTC prices in the market spots.

What's that Spot Bitcoin ETF Options?

Meanwhile, Spot Bitcoin ETF Options is a trading contract in the derivatives market that gives the holder the right, but not the obligation, to buy or sell shares of Spot Bitcoin ETF at a predetermined price within a certain period of time. Options this allows investors to speculate on Bitcoin ETF price movements.

Buy Spot Bitcoin ETF Options can be compared to buying vouchers discounts for shopping. For example, if vouchers allows you to buy goods for US$50, but the current market price is US$70, you will make a profit of US$20 if you use vouchers the.

In context Spot Bitcoin ETF Optionsif you have options to buy an ETF at a lower price than the market price, you can buy an ETF at a price strike price (specific price) which is lower and sells it on the market at a higher price, thereby making a profit from the price difference.

Another example is this, an investor buys call options (speculating on price Spot Bitcoin ETF will increase) with the strike price US$55 on Spot Bitcoin ETF which is currently trading at US$50. If the ETF price rises above US$55, investors can use options it is to “have the right” to buy ETF shares at a lower price, thereby making a profit when selling them in the market. The opposite of call options is put options.

Options and ETFs, are two of the various products in the derivatives market in general in the financial world, others are, Futures Contracts (future contract), Swaps, Forwards Contracts, Exotic Options, Credit Derivatives, Exchange-Traded Notes (ETNs), WarrantsAnd Contracts for Difference (CFDs). Each offers its own advantages and disadvantages.

The derivatives market is known as a two-way market, as it provides market participants with the opportunity to take a position in either an increase or decrease in the price of the underlying asset.

Speculators also use the derivatives market to take advantage of price movements, either by expecting an increase or a decrease. This provides liquidity and the opportunity for them to participate in the market without having to own the physical assets, moreover allowing the use of features leverage.

Bitcoin (BTC) Price Could Soon Be US$100 Thousand, Here's Why!

Bitcoin Price Catalyst, with Potential for Speculation

Introduction of derivative products such as Spot Bitcoin ETF Options this can increase market liquidity, providing more options for investors to invest in Bitcoin and related products. Additionally, the existence of products targeting these “big players” can also increase market volatility, as more speculation can occur, with investors trying to take advantage of price fluctuations.

SEC decision to allow listings and trade Spot Bitcoin ETF Options opening up new opportunities, especially for investors in the US and also the possibility of global investors through broker grew up in Uncle Sam's country.

With a better understanding of Spot Bitcoin, Spot Bitcoin ETFAnd Spot Bitcoin Optionsinvestors can make smarter decisions and take advantage of the diversity of investment instruments available. With the Bitcoin price catalyst now approaching, investors are expected to be better prepared to capture the existing growth potential. [ps]